A car breaks down. A medical need arrives unexpectedly. A home repair can’t wait.

These moments don’t come with much notice, and they rarely involve large sums of money. For many Americans, the need is modest. A few hundred dollars. Maybe a couple of thousand. Needed quickly.

This is where the small-dollar loan gap shows up. And for community banks, it’s becoming one of the most important lending conversations to address.

Not because customers are high risk. Not because banks don’t care. But because traditional lending economics were never designed for speed, efficiency, and scale at smaller loan amounts.

As customer expectations shift and alternative lenders move in, this gap is turning into a clear opportunity for community banks that are willing to rethink how small loans are delivered.

What Is the Small-Dollar Loan Gap?

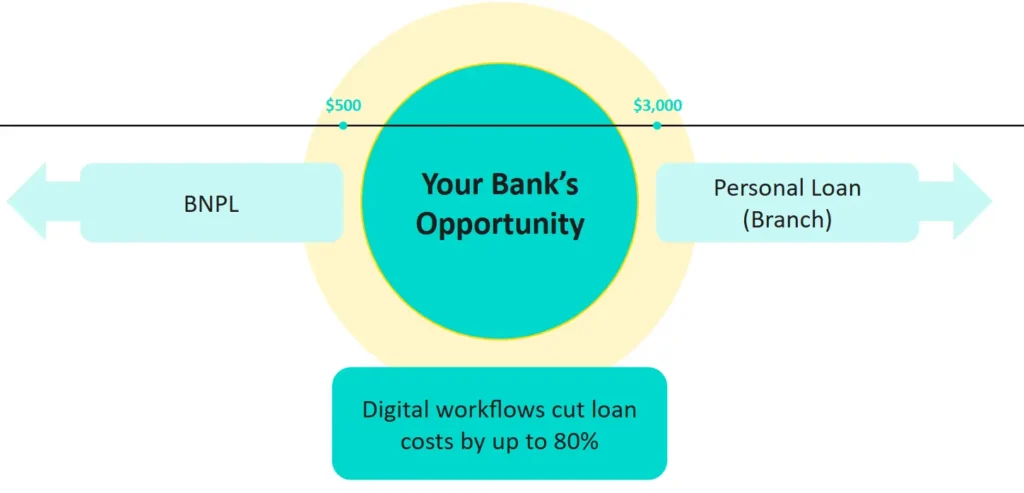

Small-dollar loans typically fall in the $500 to $3,000 range. They’re used for short-term, unplanned expenses rather than discretionary purchases. Think emergency repairs, healthcare costs, or temporary cash flow gaps.

This market sits between products that banks already know well. It’s too small for many traditional personal loan processes to make sense, and too large or too complex for most BNPL offerings. Credit cards are often available, but high interest rates and revolving balances make them an imperfect solution.

Despite steady demand, many community banks don’t actively offer small-dollar installment loans in a digital, on-demand way. The result is a gap between customer needs and bank capabilities – and an opportunity for the bank to step up with a digital offering.

Why Community Banks Have Struggled to Compete

The issue isn’t credit quality. Most borrowers in this segment already have a banking relationship, income, and a credit history. The real challenge is operational.

Traditional loan origination was built for larger balances. Manual underwriting, document collection, and servicing workflows cost more or less the same for a $1,000 loan as they do for a $10,000 loan. That math doesn’t work at scale.

Speed is another factor. Customers facing urgent expenses don’t want to wait days for approval or funding. When banks can’t move quickly, customers look elsewhere.

According to Bankrate, nearly half of U.S. adults say they couldn’t cover a $1,000 emergency expense without borrowing or selling something. When a bank isn’t visible or accessible in that moment, alternatives fill the gap fast.

Where Customers Turn When Banks Can’t Say Yes

When small-dollar loans aren’t readily available through a primary bank, customers don’t pause their needs. They pivot.

Payday lenders step in with fast access but extremely high APRs. Credit cards offer convenience but often lead to compounding debt. BNPL providers insert themselves at checkout, weakening the direct relationship between bank and customer.

Each of these options solves the immediate problem while quietly shifting loyalty away from the bank. Over time, that erosion shows up in lower engagement, fewer deposits, and reduced lifetime value.

The Economics Have Changed With Digital Lending

What’s different now is technology.

Modern digital lending platforms dramatically reduce the cost and complexity of offering small-dollar loans. Automated onboarding, decisioning, and servicing remove much of the manual work that made these loans unprofitable in the past.

When loan origination costs drop significantly, small-dollar lending becomes viable again. Banks can respond faster, approve confidently, and fund loans without sacrificing margins or compliance.

Just as important, customers stay within their trusted banking environment. There’s no need to seek external financing or manage multiple providers. The bank remains the primary financial partner at the moment of need.

Why Small-Dollar Loans Matter Beyond Revenue

Small-dollar loans aren’t just about interest income. They’re about relevance.

When a bank helps a customer through a stressful, real-life situation, the impact extends far beyond that single transaction. Customers remember who showed up. That memory influences where they keep deposits, who they trust with larger financial decisions, and how long they stay loyal.

Digitized small-dollar lending turns everyday challenges into relationship-building moments. It allows community banks to compete on speed and convenience while staying true to their relationship-driven roots.

Key Questions Community Bank Leaders Are Asking

Are small-dollar loans risky?

For existing customers with known profiles, risk is often manageable. The bigger historical risk has been operational cost, not credit quality.

Do customers actually want these loans from their bank?

Yes. Research shows that three out of four customers need small-dollar loans, and 85% of customers would use small loans if offered by their community bank, especially when the process is simple and fast.

Can small-dollar lending be profitable?

With modern digital workflows reducing origination costs by up to 80%, and automated servicing, many banks are finding that it can be both economically sustainable and strategically valuable.

The Opportunity in Front of Community Banks

The small-dollar loan gap isn’t a niche problem. It’s a widespread, everyday need that intersects directly with customer trust and loyalty.

For community banks, closing this gap means more than adding a new product. It means reasserting relevance at moments when customers are most vulnerable and most likely to remember who helped them.

Banks that adapt their lending models to meet these needs stand to strengthen relationships, protect market share from non-bank alternatives, and create long-term value in a segment that has been hiding in plain sight.

For leaders thinking about how their institution shows up when life happens, small-dollar digital lending deserves a closer look.