Embedded Lending

Blend in Perfectly

Seamlessly embed your consumer and business loans at any customer touchpoint with our white-labeled embedded lending platform.

45%

of loans could be originated via non-financial user journeys by 2027

* The Future of Customer Experience in

Embedded Lending, December 2022

Make your loans digitally accessible to customers - anywhere, anytime, in real time.

Embed any loan

Any loan or credit product that you offer to businesses and consumers, including installment loans, lines of credit, working capital, BNPL and more.

In any customer channel

Extend your lending outside your owned channels – online, in-store, via call center, ordering system and more. Offer your loans to customers at the right place at the right time – in real time.

Benefits of Embedding Your Loans

Generate alternate loan revenue streams

Increase value to existing customers

Digitally onboard new-to-bank customers

Grow your loan volumes at scale

Regain market share from fintechs

Modernize & future-proof your lending

Everything You Need for Embedded Lending

Modular end-to-end infrastructure

Integrates seamlessly with your existing tech stack so you can use only the components you actually need - or use them all

White-Labeled Customizable User Journeys

Fully branded for you and/or your merchant partner, we provide tailored customer onboarding and lending journeys

Data Analytics

Make data-driven decisions based on real-time data intelligence

Loan Program Agnostic

All your consumer and commercial loans supported under one platform

Multi-Channel Deployment

Distribute your loans across multiple channels, merchants and markets without tech duplication

Accelerated Time-to-Market

Fast-track deployment with the most efficient way to launch embedded lending programs without lengthy development cycles

Global Solution, Localized Implementation

Our global presence means we can implement your solution in any market, adhering to local regulations and best practices

Compliant by design

Built for compliance from the ground up, our platform meets leading industry standards and is continuously updated to stay ahead

Trusted by Leading Banks and Lenders

With Jifiti, we launched embedded lending across multiple merchants without building a single new system internally.

Head of Strategic Partnerships

Tier-1 Bank

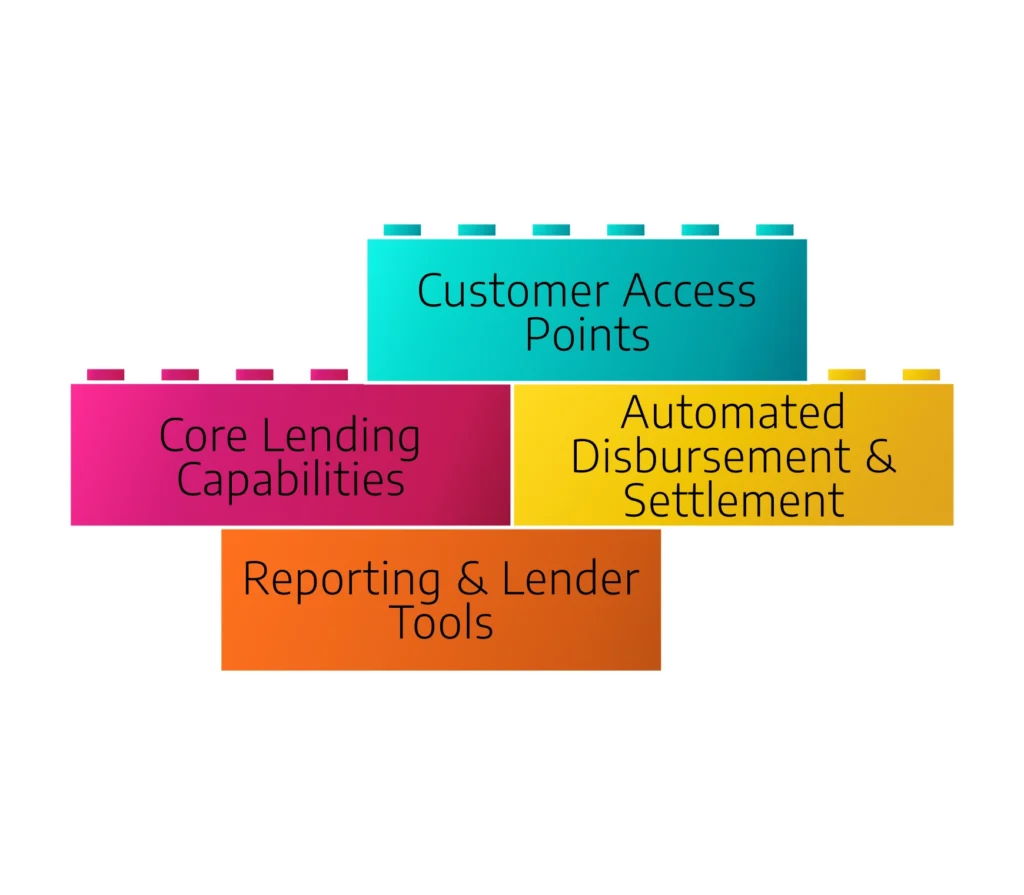

One Modular Lending Platform to Power it All

Our modular platform seamlessly integrates with your legacy system, enhancing your existing capabilities.

Pick any of the components you need to embed, digitize and automate any stage of your lending and customer onboarding workflows.

- Customer access points

- Core lending capabilities

- Automated disbursement & settlement

- Reporting & lender tools

How it works

Integrate via API with our lending platform

We work with you to configure to your needs, loan programs and custom user journeys

Launch seamlessly with whichever modules you require per merchant or use case

Scale easily to new merchants, markets and channels with APIs or our zero-integration option

Optimize through analytics and performance data