Artificial intelligence is rapidly reshaping the lending landscape. But while most conversations blur AI into a single bucket, banks that want to stay competitive need to understand a critical distinction emerging across the industry.

AI Tools for Core Lending vs Agentic AI for Lending

These two categories serve different purposes, sit in different layers of the lending funnel, and carry different strategic implications for financial institutions. Conflating them leads to gaps in strategy, missed opportunities, and misaligned investments.

This guide breaks down the difference in clear terms – and explains why banks must prepare for both.

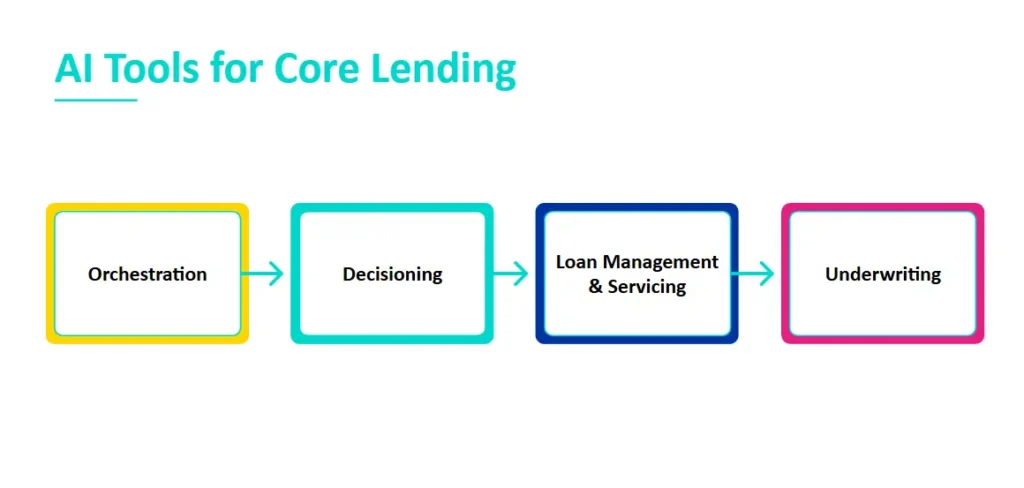

What Are AI Tools for Core Lending?

AI lending tools operate inside the bank’s core lending workflows, transforming loan execution and improving efficiency.

These systems enhance decisioning, underwriting and automate internal lending operations.

AI tools are used by lenders to:

- Process loan applications

- Verify identity and detect fraud via third-party orchestration

- Analyze income and affordability

- Underwrite and assess credit risk

- Automate decisioning based on machine-learning (ML) models

- Set dynamic, risk-based pricing

- Manage loan servicing, monitoring and collections

- Optimize portfolio performance

These are not autonomous agents acting for customers.

They are AI-powered capabilities that help banks operate faster, smarter and more efficiently.

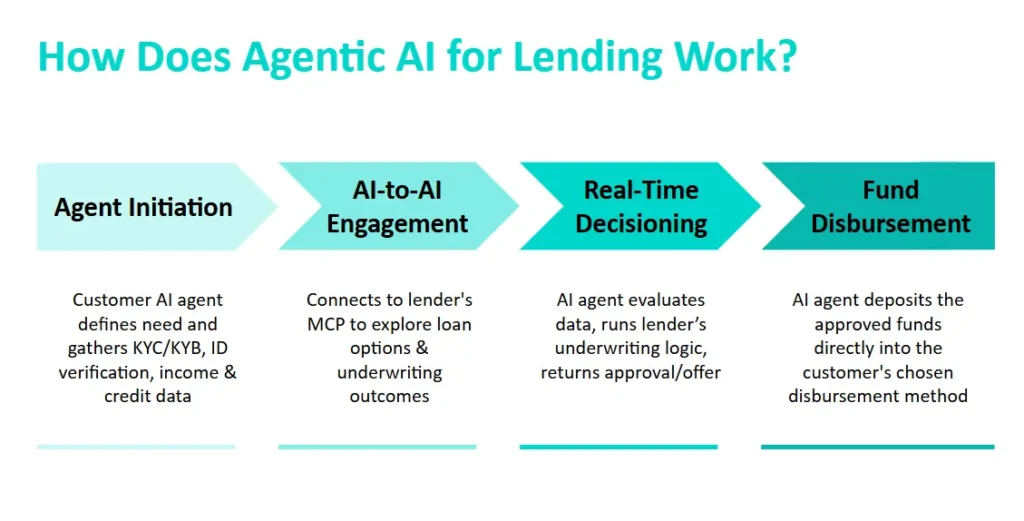

What Is Agentic AI for Lending?

Agentic AI refers to autonomous financial agents powered by large language models, decision engines and multi-step planning capabilities. Rather than being passive tools waiting for input, these agents act on behalf of consumers and businesses to complete tasks from start to finish.

Agentic AI for lending ensures that the bank systems can engage with AI agents.

For lending, this means AI agents will be able to:

- Search for relevant loan products across multiple lenders

- Compare interest rates, terms and eligibility criteria, providing customers with the best options for them

- Pre-fill and submit loan applications

- Gather and upload required documents

- Communicate with lenders’ systems to complete onboarding and decisioning

- Trigger disbursement, depositing approved funds directly into the borrower’s account (where permitted)

In other words, Agentic lending shifts the point of origination away from traditional bank-owned channels and embedded lending channels – and toward AI tools and browsers that customers use on a daily basis.

This is a front-end AI transformation that will transform how loans are discovered, originated and disbursed. Banks that aren’t ready for agentic AI risk becoming invisible to tomorrow’s borrowers.

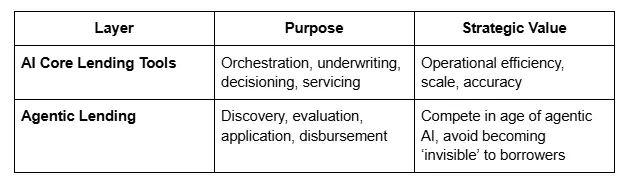

AI Lending Tools vs Agentic Lending: Strategic Impact

- AI Lending Tools:

- Operational efficiency

- Lower cost-per-loan

- Better risk accuracy

- Scalable lending infrastructure

- Agentic Lending:

- New distribution channels

- Greater competition between lenders

- Transparent pricing and eligibility

- Rapid customer acquisition shifts

Both layers are essential – but they solve different problems for financial institutions.

Why Banks Must Prepare for Both

Banks that focus only on internal AI tooling will modernize operations, but they risk losing origination volume to agentic channels.

On the other hand, banks that focus only on agentic interfaces without strengthening underwriting and servicing will struggle to support the speed and scale AI distribution demands.

The future of lending belongs to banks that have both the exposure layer (to be discoverable by agents) and the intelligence layer (to process, approve and service loans efficiently).

How These Two Layers Will Converge

Over time, front-end agentic AI and back-end AI tools will form a single, adaptive lending ecosystem.

Imagine a world where:

- AI agents evaluate customer needs

- Instantly routing applications to lenders with compatible and machine-readable origination and AI-decisioning systems

- Real-time approvals

- Automated servicing and risk monitoring

- Transparent, dynamic pricing

Banks that prepare their APIs, underwriting engines and data infrastructure today will gain a first-mover advantage tomorrow.

Some Questions Banks Should Be Asking Now

On Core Lending AI Tools:

- Are our decisioning and underwriting models dynamic and in real time?

- Do the vendors we work with have AI capabilities?

On Agentic Lending Readiness:

- Are our lending workflows digitized and automated?

- Is our data structured, real-time and AI-auditable?

These questions determine whether a bank is ready for both sides of the AI lending coin.

Conclusion: The Two-Sided Future of AI in Lending

AI will not replace lenders, but lenders who use AI will outperform those who don’t – and lenders who understand both sides of AI will lead the industry.

- Agentic AI changes where customers find and apply for credit.

- AI Lending Tools change how efficiently banks originate, approve and manage credit.

Banks that develop a unified strategy across both layers will be positioned to grow in an increasingly AI-driven financial ecosystem.

Disclaimer: The information in this article is for informational purposes only, and should not be construed or relied upon as legal advice on any subject matter. The author is not responsible for any consequences whatsoever arising from the use of such information.