Latest Webinar: The Role of Digital Wallets in Consumer Lending. Watch on demand →

With actionable data insights, real-time reporting and a custom lender portal at your fingertips, managing and optimizing your loan programs just got easy.

higher conversion rate for

top EU lender*

* Based on insights from Jifiti’s

data analytics suite

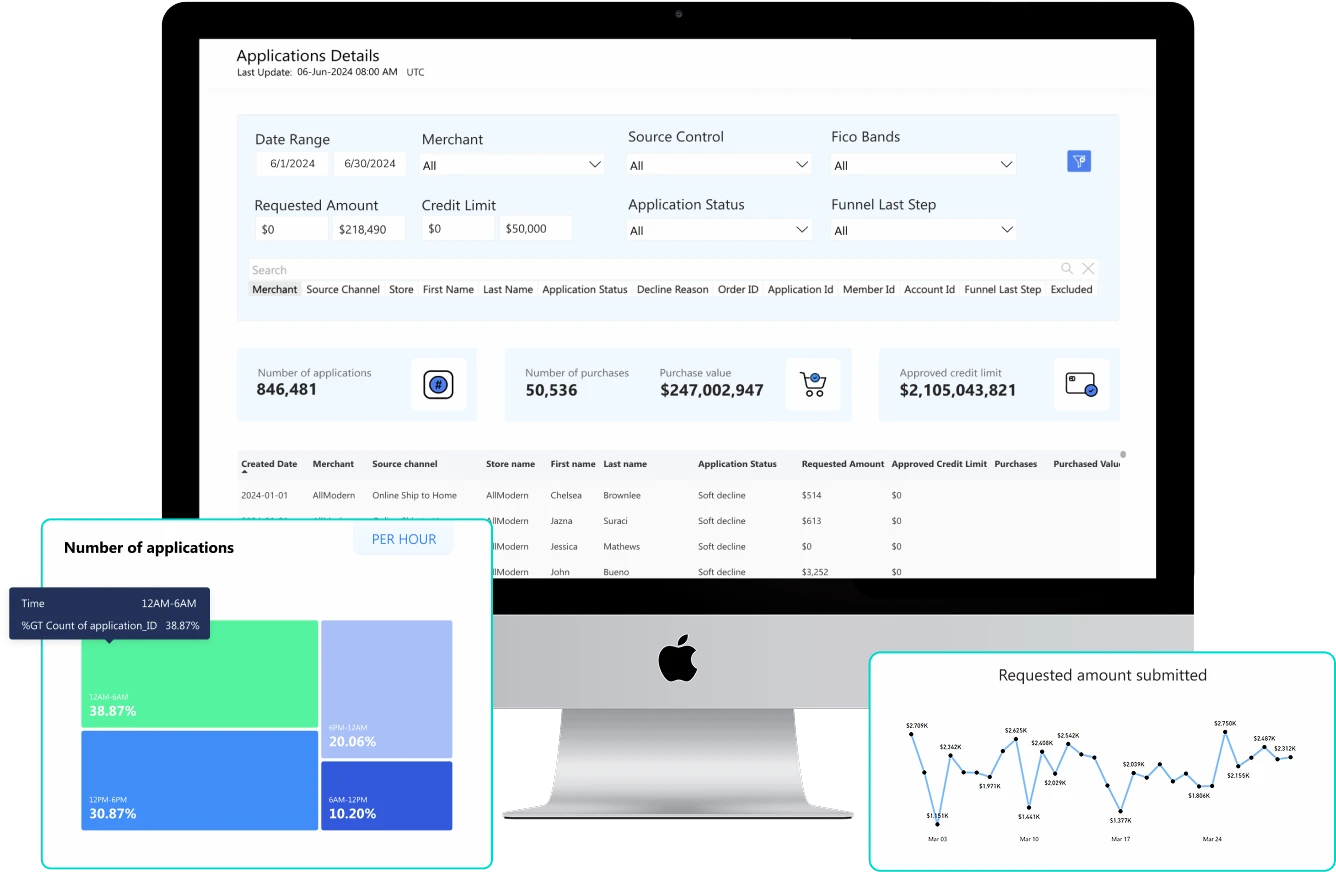

Our robust Power BI loan analytics suite provides a single source for all your loan analytics needs. Manage your lending programs based on actionable business intelligence.

Harness up-to-date reports to track, analyze and optimize your conversion funnels.

Drill-down into KPI performance per channel, market and loan type.

Gain big-picture insights to make data-driven decisions.

Slice & dice data

Optimize conversion funnels

Control permissions & security

Analyze details & trends

Create & export reports

Access up-to-date information

With our real-time reporting dashboards, you gain actionable data insights at every stage of the funnel, from high-level market data down to individual transactions.

You can view or export custom reports by merchant, location, status, channel and more, over a specific period of time.

Robust data analytics tools provide micro and macro insights, enabling you to set, compare and measure both short and long-term KPIs.

Customizable maps, charts and graphs make analyzing your loan program performance simple and intuitive.

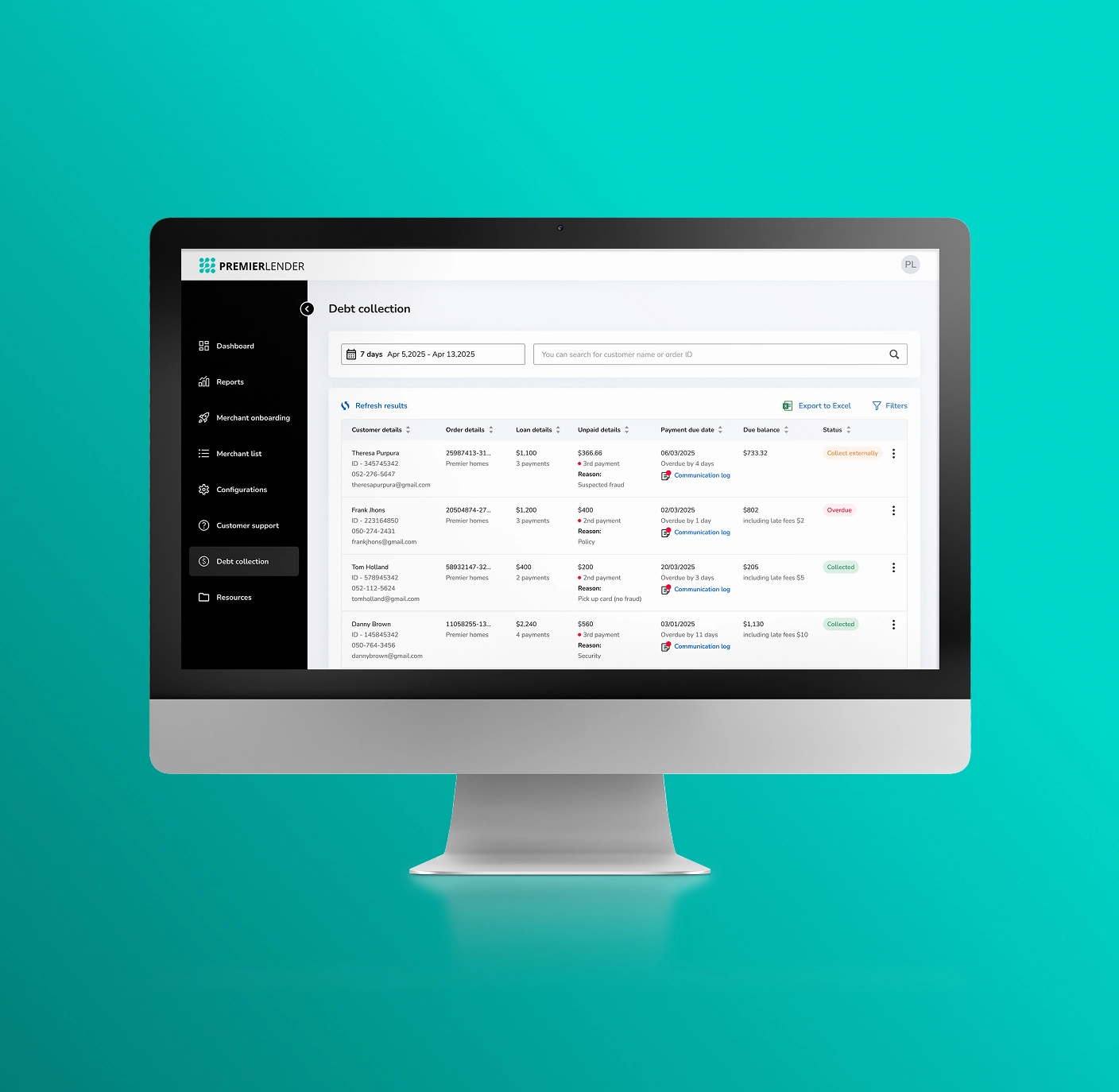

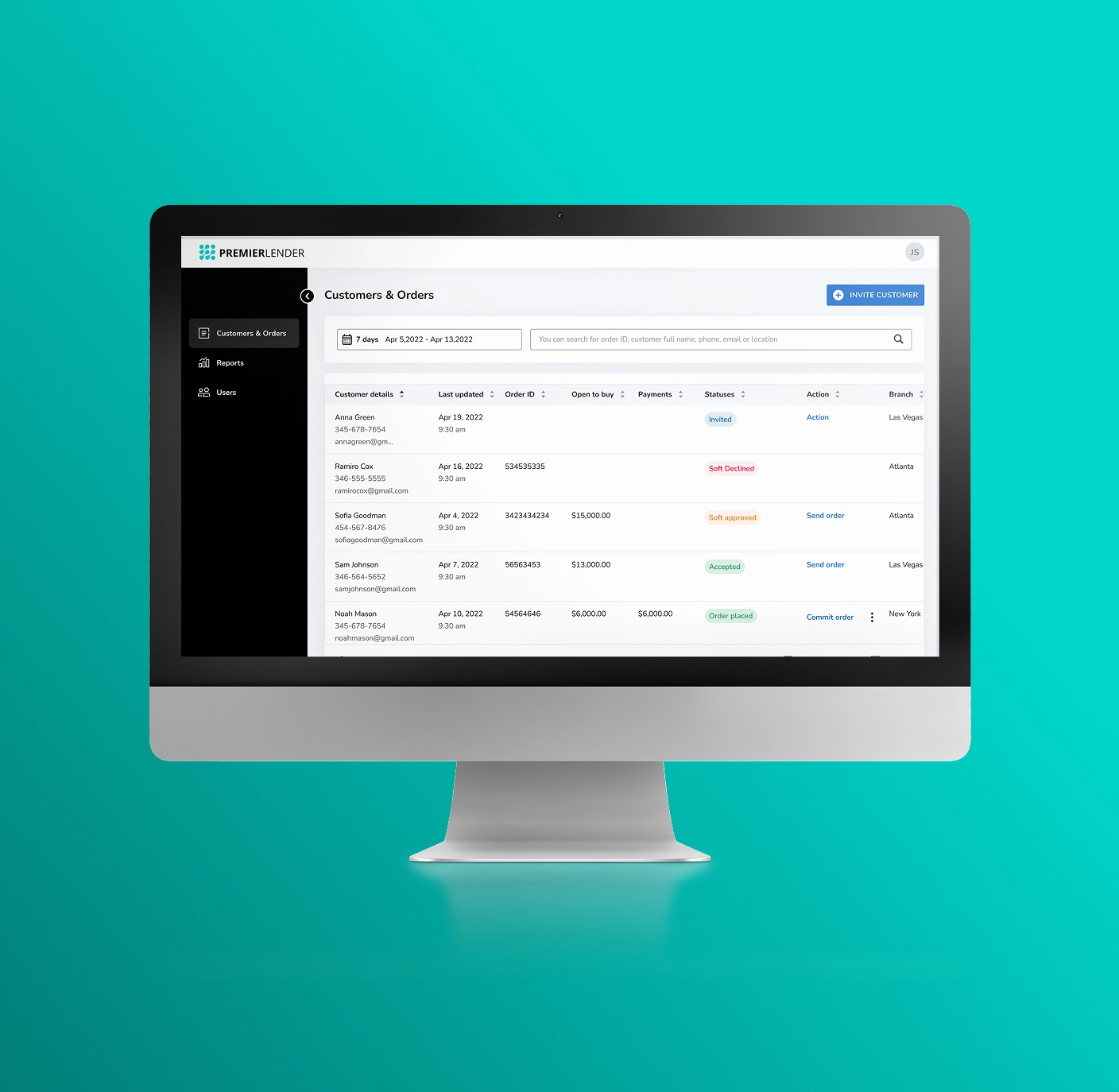

Dedicated portal for lenders to manage applications, review loan statuses, handle collections, export data and more.

Armed with the information needed to assist customers both pre & post decisioning, you can effectively:

Transform any device into a customer financing control panel, enabling remote customer onboarding and management of embedded lending offerings for any sales flow, use case or project where the seller or service provider is involved in the purchase process.

Through the portal, sellers can easily initiate financing applications for customers, release approved funds for payment and complete the order or purchase. No integration is required with the point of sale.

Insights

Lender A noticed that Merchant A got off to a good start in June, but experienced a nearly 14% drop in conversions the following month.

Actions

By A/B testing the customer application flow, we determined that a new step, required by the lender for regulatory compliance, is what was lowering the conversions. After working closely with the lender’s compliance team, we adjusted the flow in a way that achieved the optimal balance between regulatory compliance and user experience.

The Data-Driven Outcome

By using data to analyze the root cause of the conversion drop, the lender was able to take action and increase their customer conversion rate to 69.2%.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |