Latest Webinar: The Role of Digital Wallets in Consumer Lending. Watch on demand →

The Virtual Expense Card That Fits Any Mold

We de-complicated the world of corporate expenses

Most companies aren’t large enterprises and don’t need bulky, expensive expense platforms – they need something simple, intuitive, flexible and fast. JelloCard is designed for companies that move quickly and want to stay in control without slowing down.

With easy employee requests, instant virtual card issuance and powerful admin controls, JelloCard delivers the perfect balance of agility and oversight – so you can manage spending without managing complexity.

Create your JelloCard account and configure how your company spends - by team, use case, or budget.

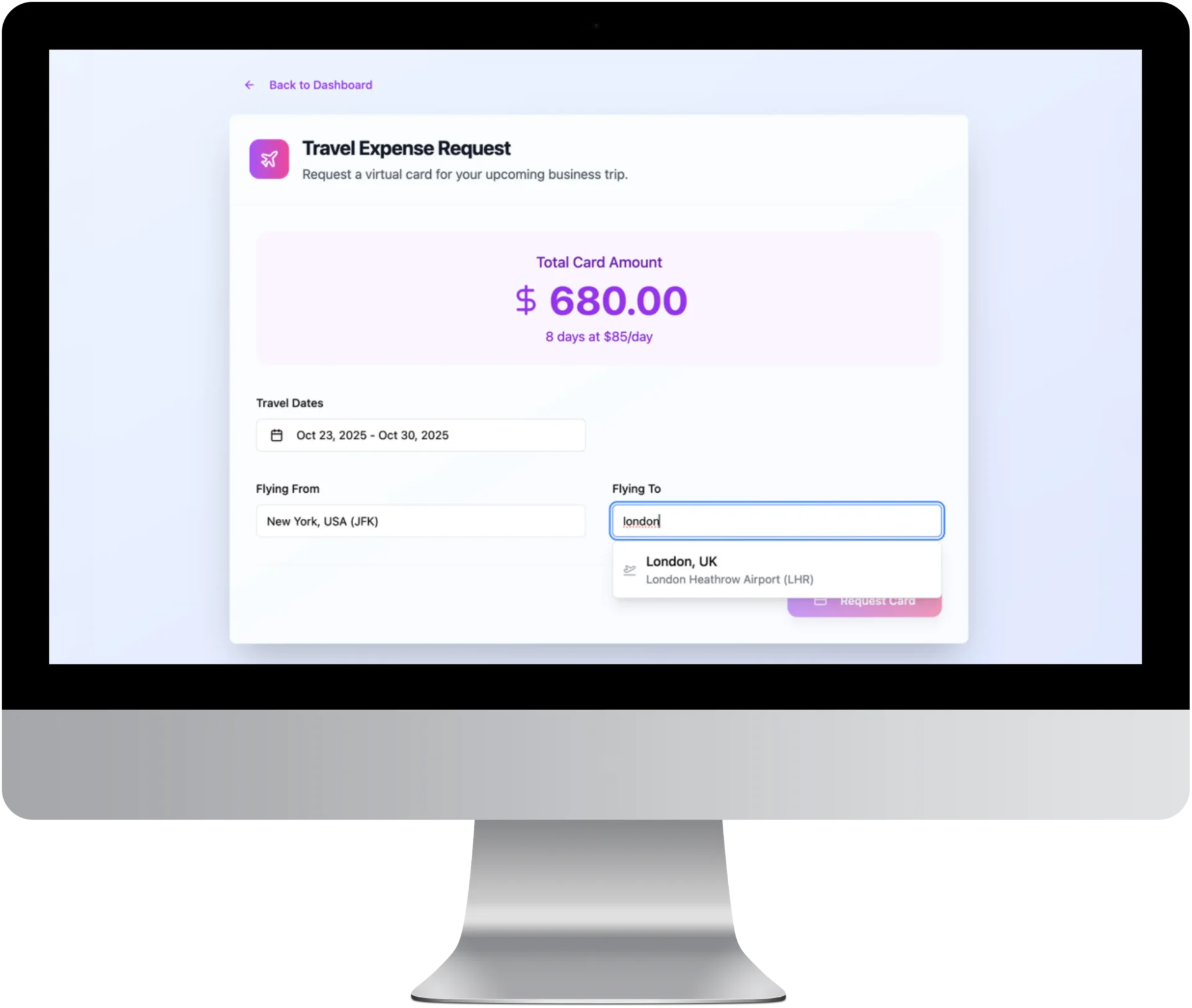

Any team member can log in and request a virtual card for an approved use case - like travel, SaaS, or general spend.

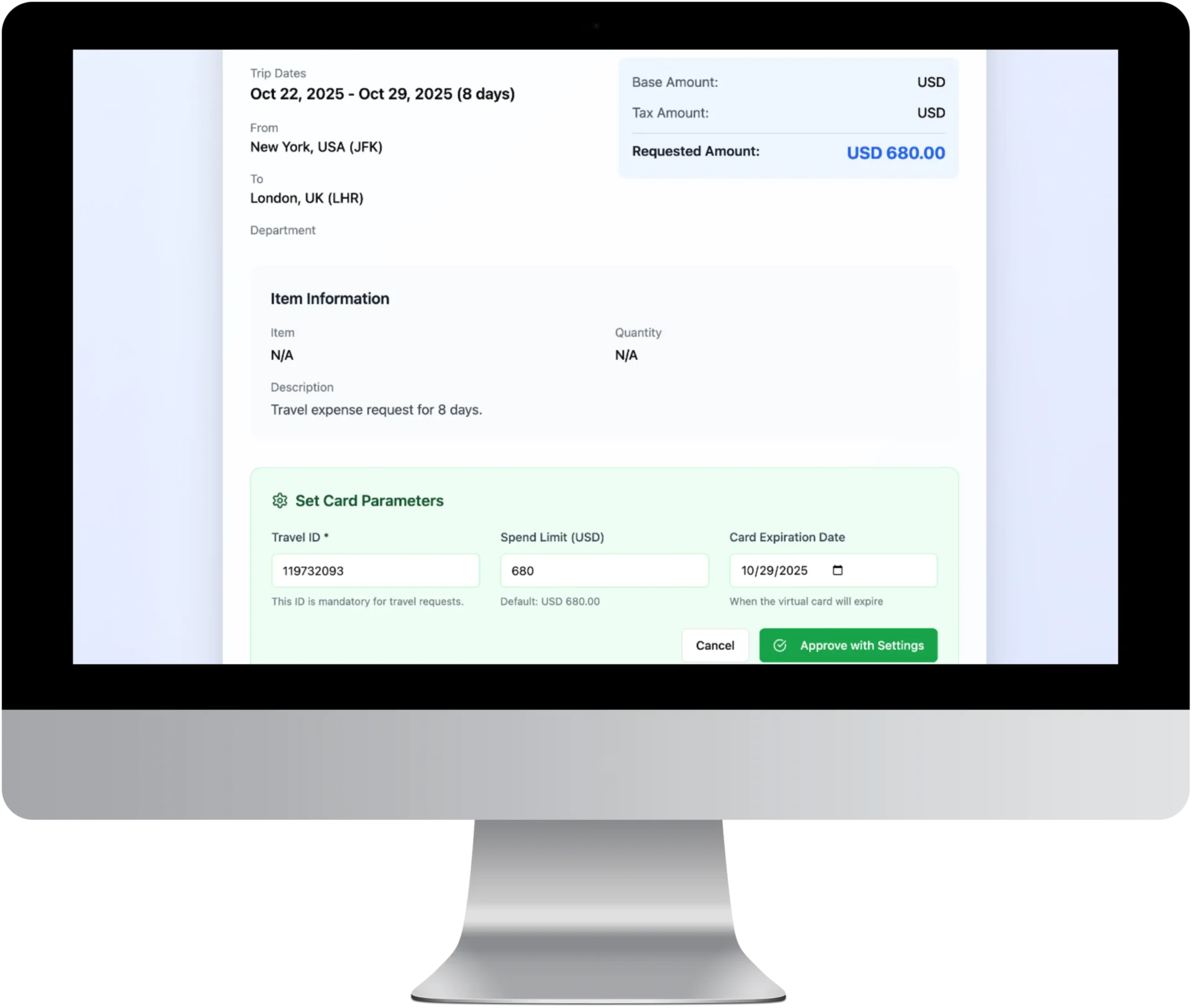

Your designated company admin gets the request, reviews the details, and approves it. Done.

Instant issuance of a virtual Mastercard - branded with your company’s logo and ready to spend within the approved limits.

Set Spending Limits

Per card, per day, per scenario

Choose Where It Works

Control spend by merchant category or vendor

Track Every Transaction

Real-time visibility into every card, every spend

Time-Based Usage

Automatically disable cards after a trip or project ends

Getting started with JelloCard is as easy as it gets. There’s no complex onboarding, no IT setup, and no weeks-long implementation.

Just sign up, set your expense rules, and your team can start requesting and receiving branded virtual cards the very same day. It’s the ultimate in corporate spending control – ready to go as fast as your business.

JelloCard is backed by Jifiti’s robust financial infrastructure and regulatory foundation. The company’s Compliance and Privacy framework has been designed to meet the unique needs of our industry. To ensure the trust of our partners and customers, we have implemented a robust set of regulatory policies that aim to stay ahead of the curve of legislation and industry guidelines.

Jifiti’s ISO/IEC 27001 certification indicates our compliance with leading international data security and risk management standards. Visit our ISO 27001 page.

Jifiti is PCI/DSS compliant, meaning that all card data is 100% secured through a stringent set of requirements established by the PCI SSC (Security Standards Council).

Jifiti is SOC 1 Type II audited, underscoring the robustness of our internal controls over financial reporting and our unwavering commitment to data integrity and operational oversight.

Jifiti is SOC 2 Type II audited, serving as assurance that Jifiti processes and stores client data in a secure manner.

Jifiti’s compliance with the Digital Operational Resilience Act (DORA) reaffirms our ability to provide EU banks with secure, regulatory-compliant lending solutions.

As a licensed, regulated e-money issuer, we’re able to serve the growing needs of our bank, lender, financial services and merchant clients with a broader scope of payment products and services.

Our EMI license serves as comprehensive validation of our company’s robust compliance and regulatory standards, which also include PCI/DSS, SOC 2 and ISO 27001 certifications.

Visit our EMI License webpage for more information.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |