Off-the-Shelf

Lending Platform for

Credit Unions

Give your members the digital lending experience they expect while keeping relationships, data and decisions inside your credit union.

Off-the-Shelf. On Brand.

Members expect digital experiences that match big banks and fintechs, but without sacrificing your personal, community-first service.

Our white-labeled, off-the-shelf lending platform lets you offer fast, seamless digital lending that keeps your members close and attracts new ones.

Modernize How You Lend to Members

Direct-to-Member Loan Offers

Offer members pre-approved installment loans directly in your digital channels, building deeper member relationships.

Automated Lending Workflows

Simplify onboarding, origination and loan servicing with end-to-end digital, automated workflows for maximum efficiency.

Real-Time Fund Disbursement

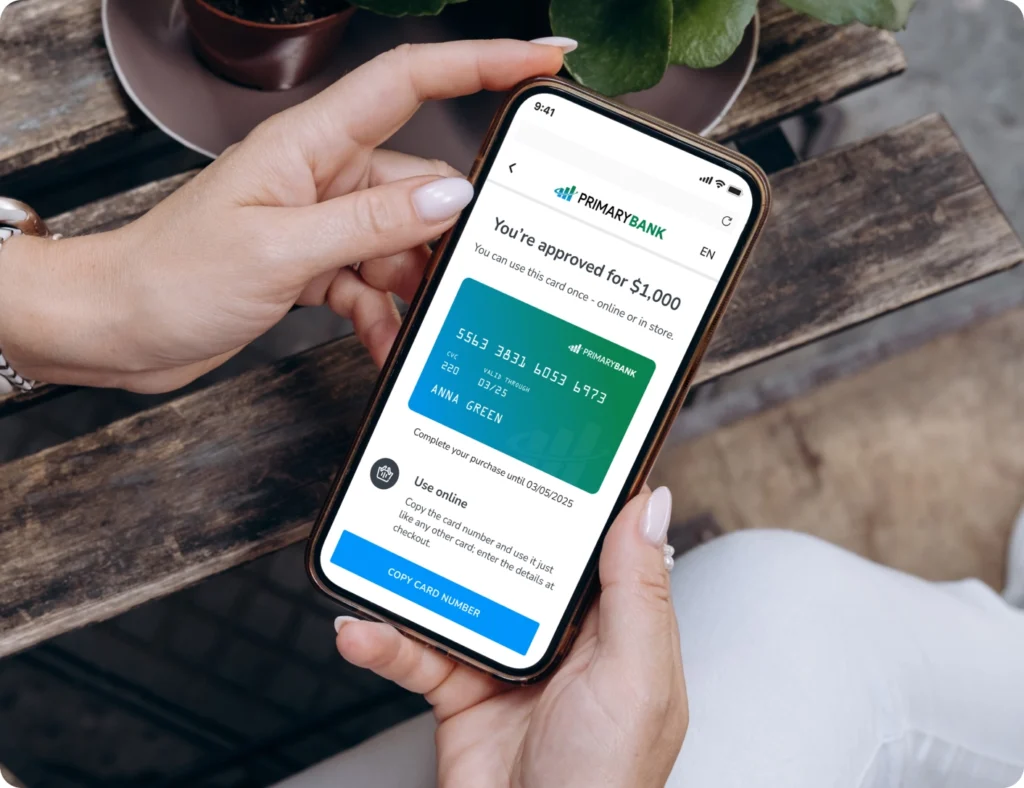

Give members multiple ways to receive funds instantly, from white-labeled virtual cards to API-driven disbursement flows.

Reporting & Lending Tools

Gain full transparency and control through advanced data reporting and a dedicated management portal for your credit union.

3rd-Party Orchestration Layer

Gain seamless access to any 3rd-party service your lending stack needs through a single API connection with our orchestration layer.

How It Works

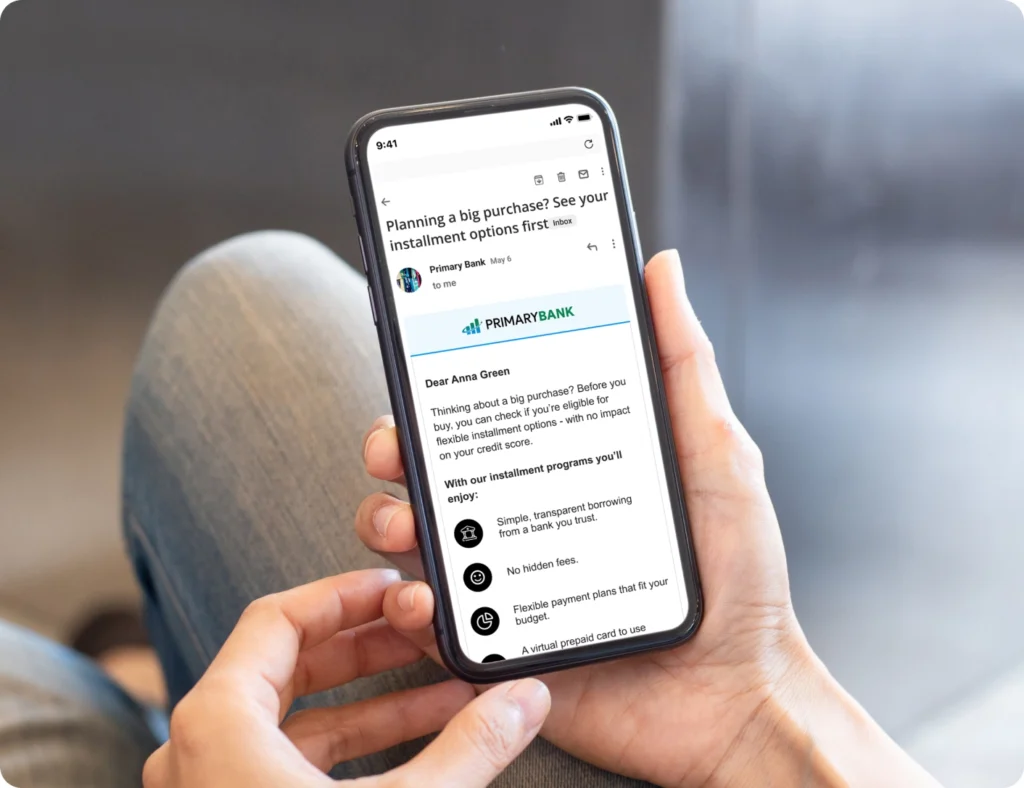

Application Initiation

Pre-approved customers start their application via a promotional email or a banner on your website or app, directing to a dedicated application link.

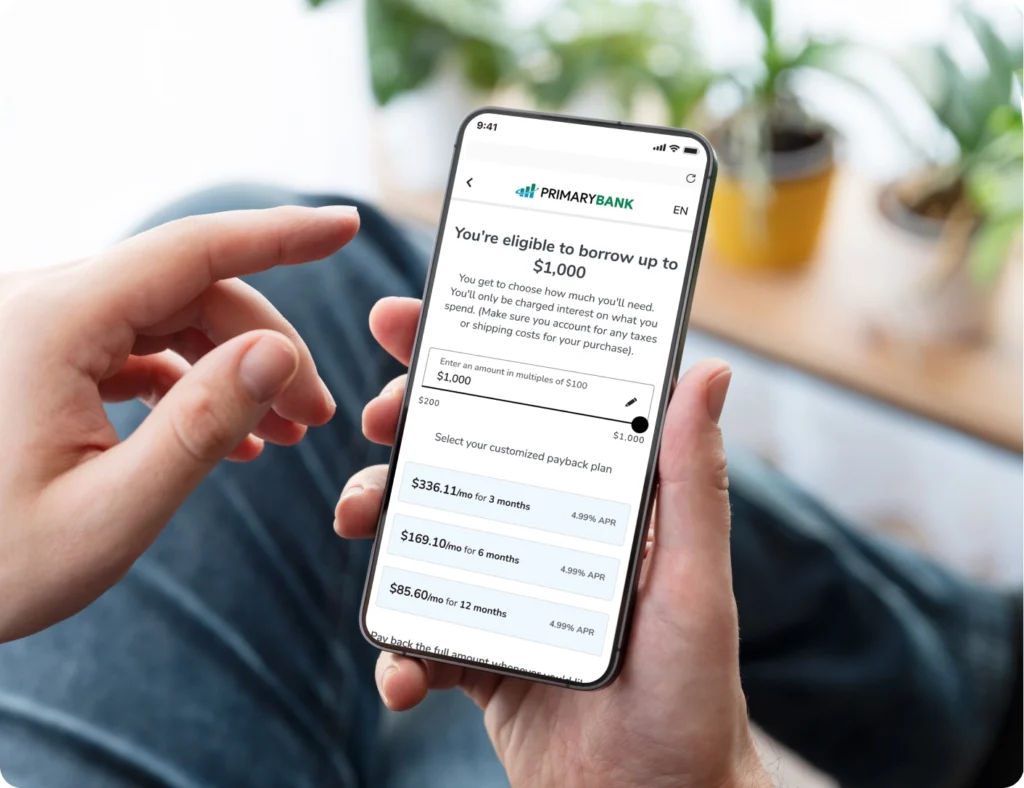

Loan Origination

Customer selects loan amount, picks their preferred offer, submits full digital application and gets approved in real time.

Funding & Purchase

Customer receives a virtual card, linked to the approved funds, on their mobile device. This can either be added to their digital wallet for easy spend or used to pay at checkout online or in-store.

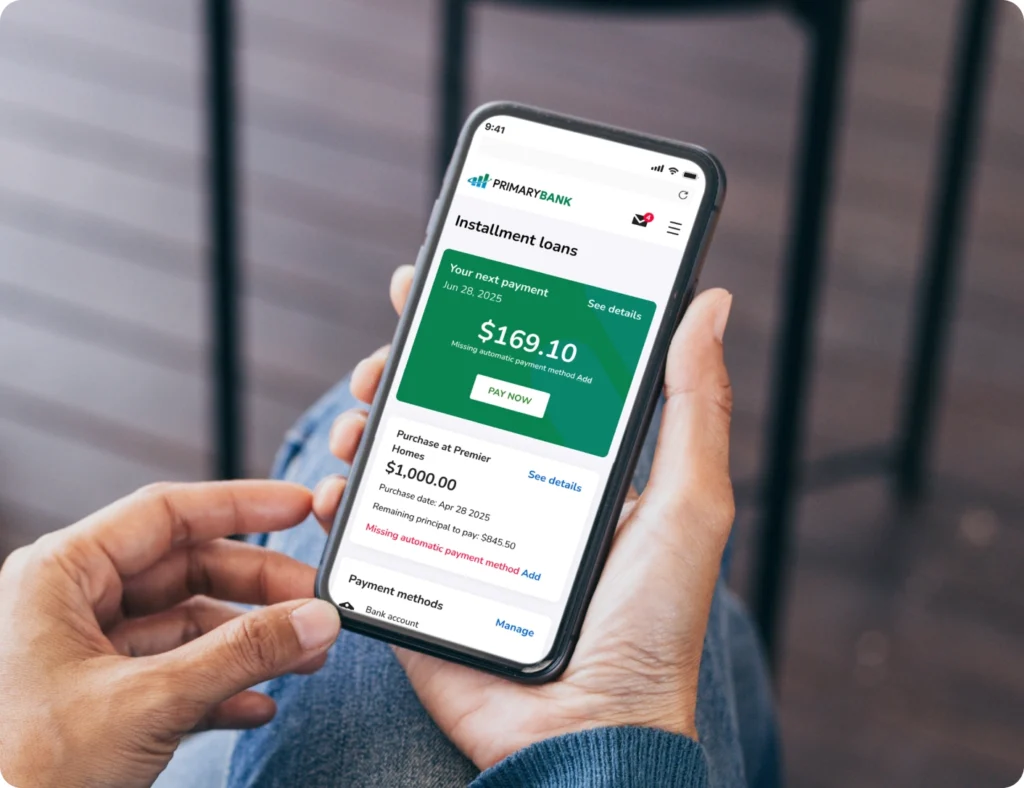

Loan Servicing

Self-service portal where the customer can easily check their loan status, make repayments and manage their payment method.

The Untapped Installment Lending Opportunity

A member needs a loan to buy a $1,300 TV.

Too big for BNPL, too small for a personal loan.

What are their options?

Credit card? High interest.

Store loan? Short repayment period.

That gap is an untapped installment lending opportunity for your credit union.

With ready-made technology from Jifiti, you can deliver your installment loans to pre-approved members directly through your digital channels – instantly and in your brand.

Compete Digitally. Serve Personally.

Your App

Serve members with pre-approved, personalized installment loans, available directly in your app.

Your Website

Grow membership with easy online onboarding, automated lending workflows, and instant decisions.

Email Campaigns

Engage members with personalized, pre-approved loan offers delivered straight into their inboxes.

Built for Compliance

Compliance is built into every stage of the lending journey, helping credit unions stay aligned with evolving regulations without adding operational burden or risk.

Our dedicated compliance team continuously monitors regulatory changes and maintains required certifications.

Ready to nerd out?

Great. Cause we have API documentation for credit union integration.

Hear from our clients (the white-labeled way)

Vice President Product

One of the top 20 largest banks in the US

Service Experience Leader

Top 10 largest retailers worldwide

Top 3 Bank in Spain

Vice President Product Management

US Bank with 1 Trillion in Assets

Payment Solutions

Global Construction Equipment Manufacturer

VP Finance

Financial Arm of Global Construction Equipment Manufacturer