AI Transformation for Lending

Give Your Lending Stack

an AI-Lift

Accelerate your AI transformation with a lending platform that ensures agentic AI discovery, automates your lending workflows and boosts efficiency across every stage of lending.

The next era of lending is powered by AI

AI is redefining where lending journeys begin and how banks and lenders deliver their loans efficiently and at scale.

Jifiti helps you build for AI transformation – so you can streamline operations, optimize workflows, cut costs, and compete in the AI-era lending marketplace.

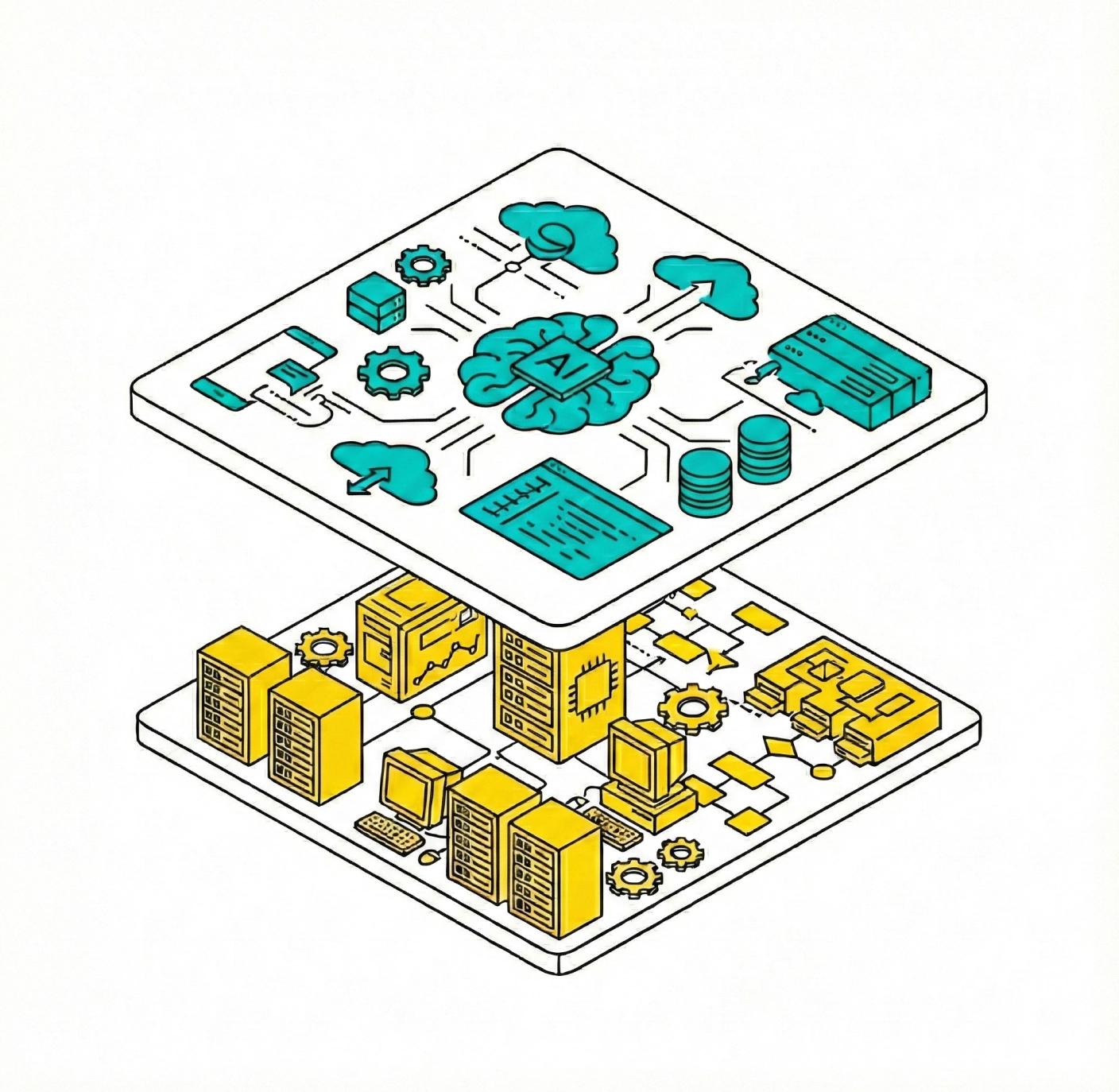

The Two Layers of AI in Lending

To truly compete in the AI-driven future of lending, banks and lenders need to incorporate both layers of AI into their lending stack:

Agentic Lending (Discovery & Origination)

AI agents are emerging as the new gateways for borrowers seeking credit. Banks that aren’t optimized for agentic lending, risk becoming invisible in the financial journeys of tomorrow’s borrowers.

AI Tools for Core Lending

AI tools that determine how lending is executed – including for underwriting, decisioning, fraud, affordability, risk and collections – driving speed, scale, and accuracy across the lending lifecycle.

Why Choose Jifiti for AI Lending Transformation

Connect to AI-optimized KYC, fraud, scoring, income verification, open banking and more best-of-breed specialist services through one API connection.

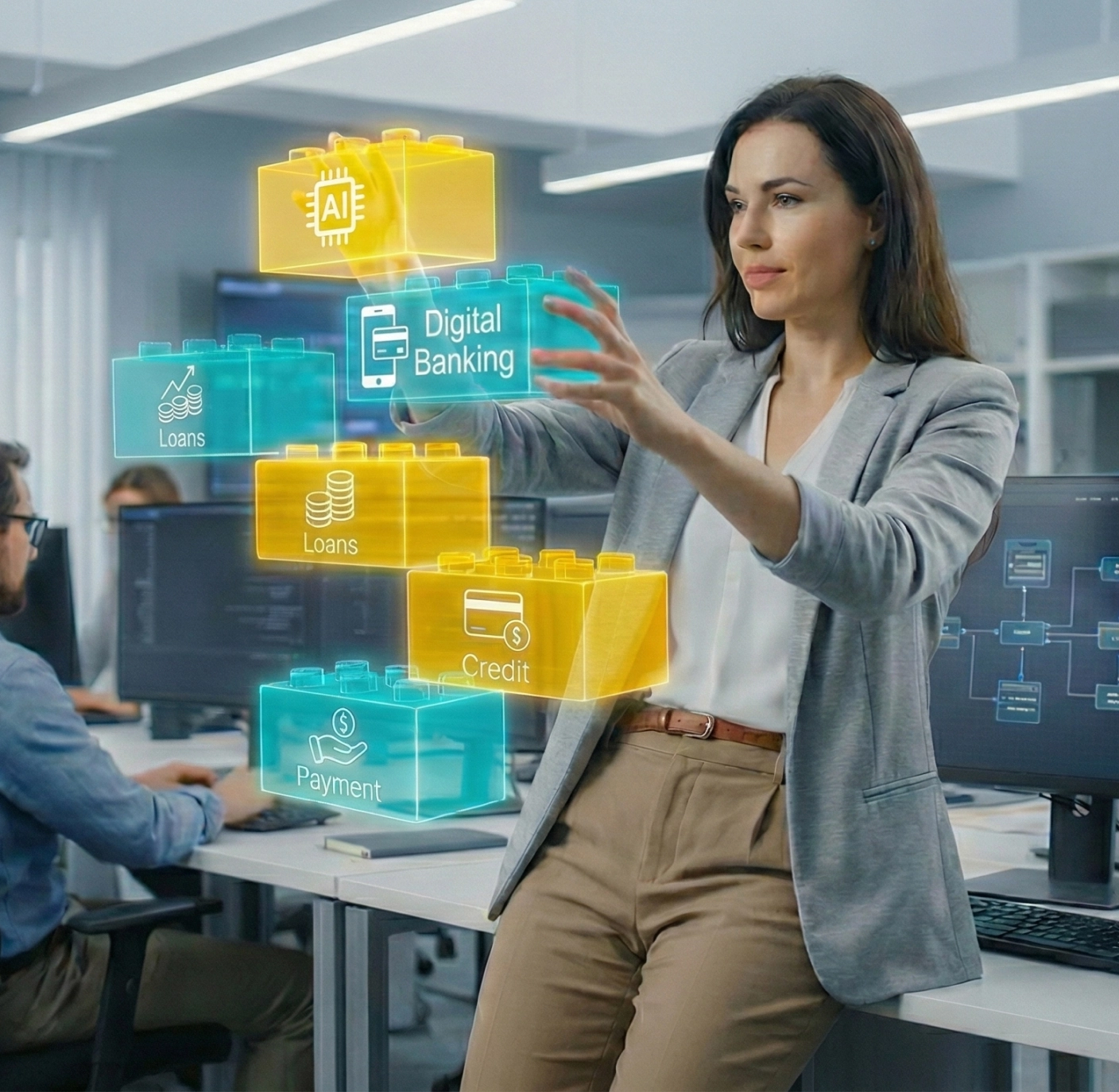

Digital customer onboarding, automated loan orgination, underwriting, decisioning and servicing - all integrated and optimized for AI.

Essential for both agentic AI discovery and intelligent origination, as well as AI-driven decisioning and underwriting.

Seamless integration with your existing systems so you can add your AI layer without ripping-and-replacing your legacy infrastructure.

Adopt only the components your lending stack actually needs, and expand as AI maturity grows.

Trusted by Leading Banks and Lenders

With Jifiti, we launched an embedded lending offering across multiple merchants without needing to build a new system internally.

Head of Strategic Partnerships

Tier-1 Bank