Ready-to-Lend

Platform for

Community Banks

Lend a hand to your customers with the loans they really need. Digital onboarding and origination cuts loan costs by up to 80% and gives your customers the experience they expect.

Big-Bank Tech Once Felt Out of Reach. Now It's Out the Box.

For years, only tier-1 banks and fintechs had access to next-generation lending tech.

They moved faster.

Approved smarter.

Delivered seamless digital experiences your customers came to expect.

That’s all changed.

You can now access top-tier lending technology, repackaged into an out-of-the-box platform just for community banks.

One Modular Platform to Power It All

Direct-to-Customer Loan Offers

Offer customers your installment loans via your own digital channels, so they never need to look outside your bank.

Automated Lending Workflows

Digitize & automate your onboarding, origination and loan management for improved operational efficiency.

Real-Time Disbursement

Broad array of fund disbursement options, from a virtual-card-in-a-box solution to customizable APIs.

Reporting & Lender Tools

With our robust data reporting platform and custom lender portal, you gain full transparency and control.

3rd-Party Orchestration Layer

A single API connection with our best-of-breed orchestration layer gives you seamless access to any 3rd-party service your lending stack needs.

How It Works

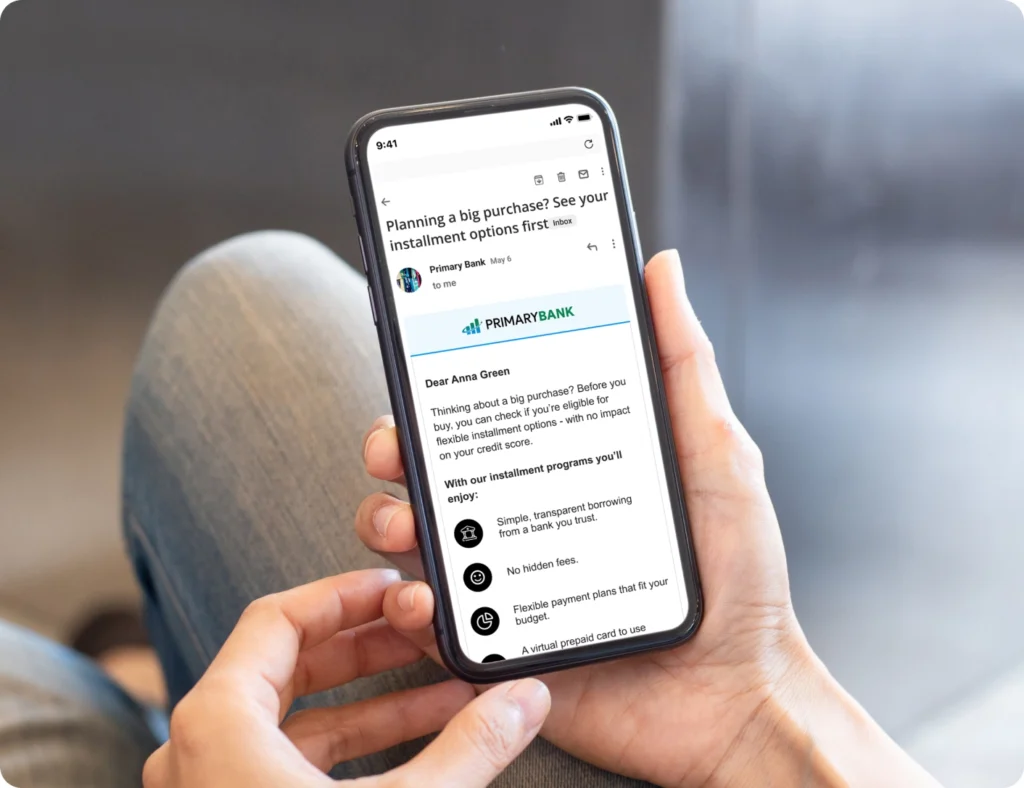

Application Initiation

Pre-approved customers start their application via a promotional email or a banner on your website or app, directing to a dedicated application link.

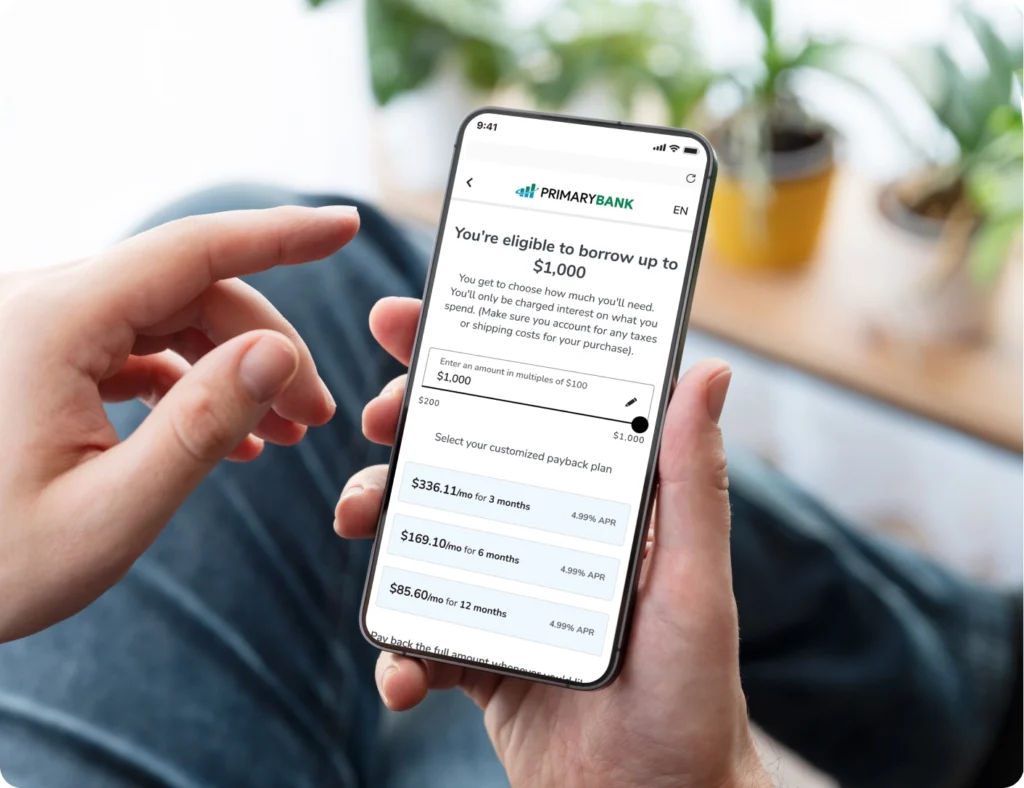

Loan Origination

Customer selects loan amount, picks their preferred offer, submits full digital application and gets approved in real time.

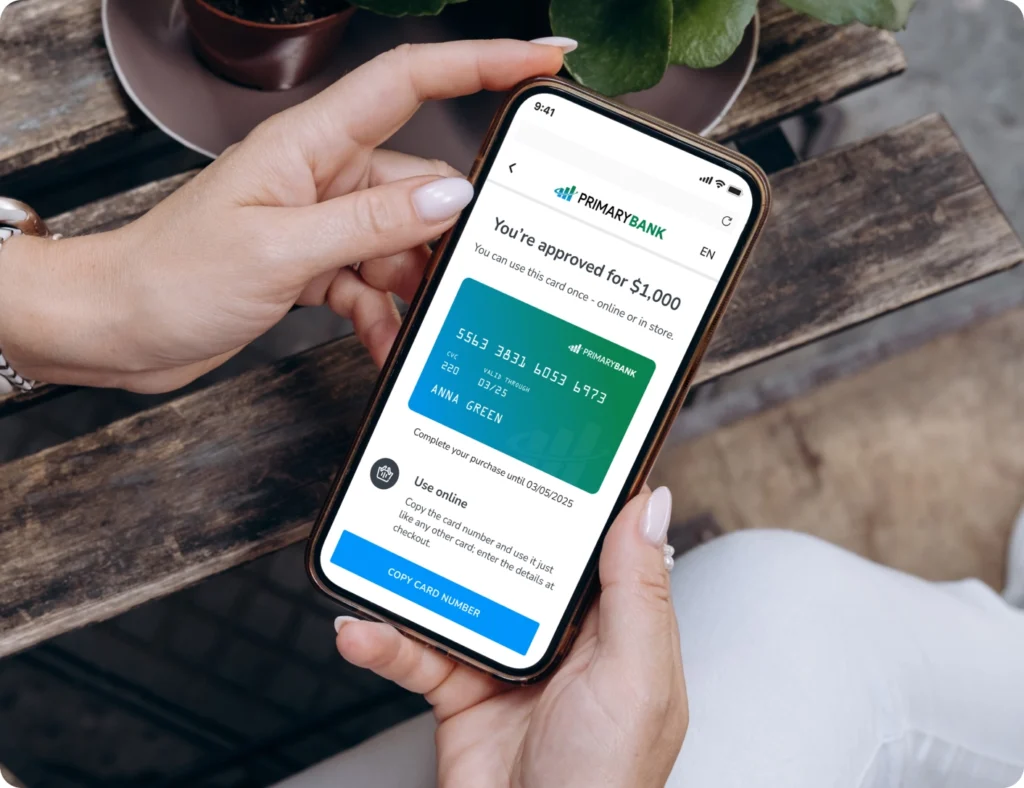

Funding & Purchase

Customer receives a virtual card, linked to the approved funds, on their mobile device. This can either be added to their digital wallet for easy spend or used to pay at checkout online or in-store.

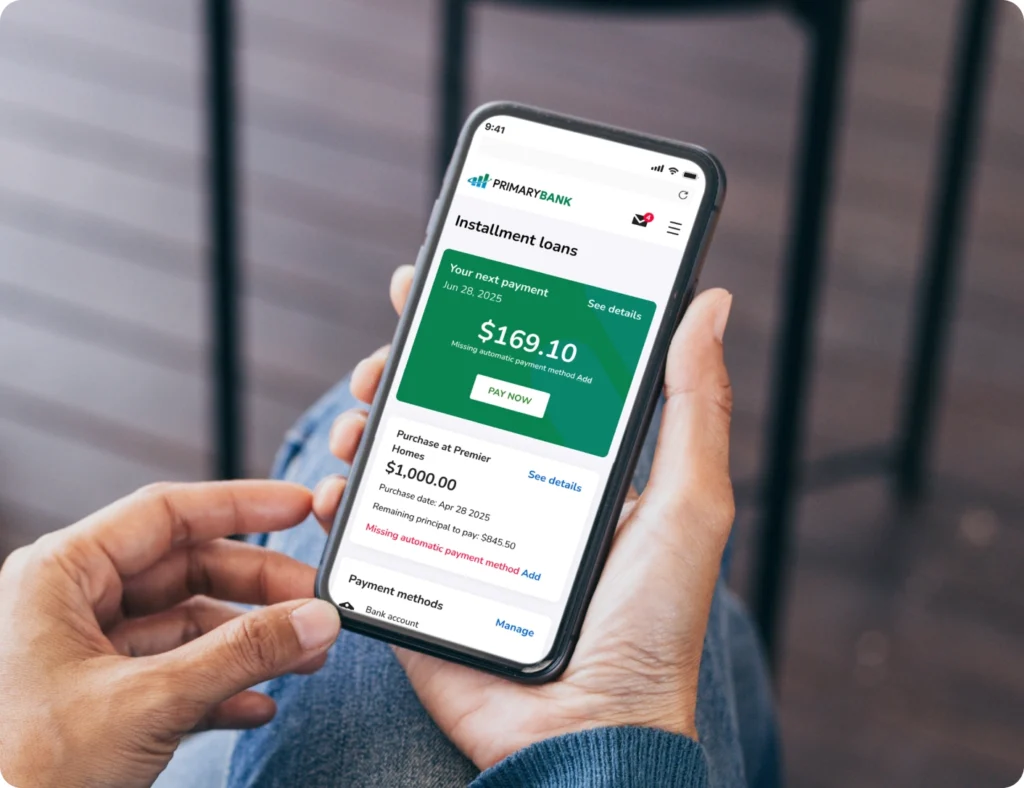

Loan Servicing

Self-service portal where the customer can easily check their loan status, make repayments and manage their payment method.

Lend a Hand to Your Existing Customers

Life happens…

A car repair. A medical bill. A home improvement.

A few thousand dollars, needed quickly.

Small-dollar loans are costly to originate, manual workflows slow everything down, customers need financial help faster than banks can move.

That’s where Jifiti’s lending platform comes in – providing you with digital flows, automated approvals and instant virtual card disbursement.

Compete in the Age of Digital Lending

Bank App

Support your customers with small loans for life’s unexpected moments - delivered digitally & cost-effectively.

Bank Website

Convert new-to-bank customers with seamless digital onboarding, automated lending workflows and real-time approvals

Embedded Lending

Empower local businesses to instantly offer loans of any size - turning their transactions into a customer acquisition channel

for your bank.

Fully Compliant By Design

Jifiti bakes compliance into every step of the lending journey, helping community banks stay fully aligned with evolving regulations without adding workload or risk.

Our compliance team ensures we stay up-to-date with the latest industry regulations and certifications.

Ready to nerd out?

Great. Cause we have API documentation for community bank integration. Click on the button below and we’ll get you set up.

The people have spoken

Vice President Product

One of the top 20 largest banks in the US

Service Experience Leader

Top 10 largest retailers worldwide

Top 3 Bank in Spain

Vice President Product Management

US Bank with 1 Trillion in Assets

Payment Solutions

Global Construction Equipment Manufacturer

VP Finance

Financial Arm of Global Construction Equipment Manufacturer