Disbursement & Settlement

A full menu of

automated loan

disbursement options

Give customers instant, seamless access to approved funds. Pick from our menu of disbursement & settlement options, configure disbursement logic once, then automate across programs and channels with full control and visibility.

79%

of approved credit lines

don’t get used*

* Accenture

Put your loans to good use

By giving customers immediate, convenient access to their approved loan funds, banks and lenders experience higher credit utilization and stronger portfolio performance.

Our technology provides flexible fund disbursement methods that adapt and scale with every loan program, use case and customer need.

Why automate your fund disbursement?

Real-time fund transfer

Seamless, instant transfers to the customer or seller based on your credit terms

Scale without limits

Adapt to any customer or partner need while keeping controls centralized

Program-level rules

Disburse by pre-defined rules per loan product, seller, channel or risk tier

Full control and flexibility

Supports refunds, chargebacks and partial settlements

Built for multiple fund disbursement methods

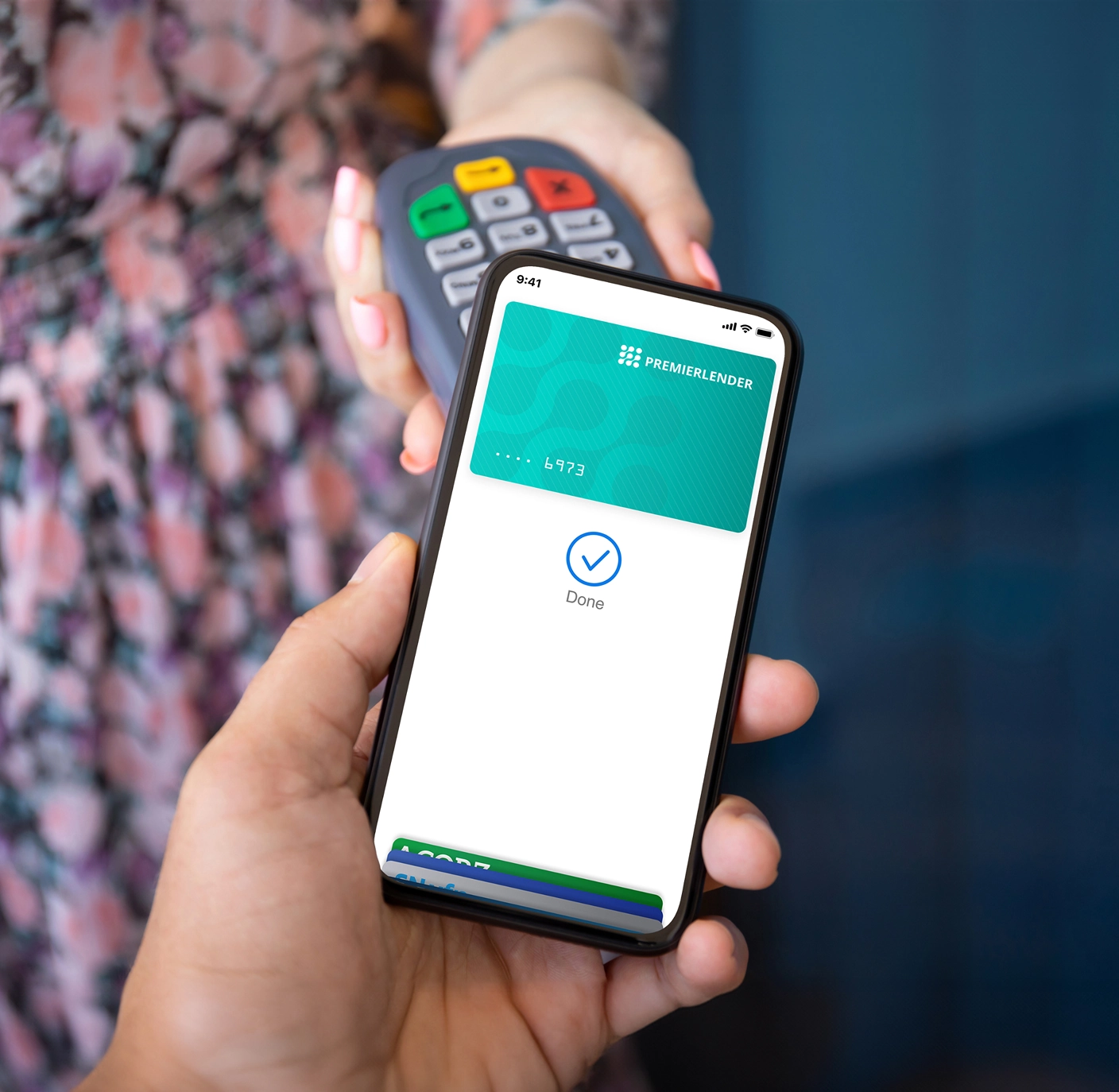

Our Tap Now, Pay Later™ technology lets customers instantly load approved loan funds into their digital wallet via a virtual card - directly from the financing application.

They can then ‘tap to pay’ using Apple Pay or Google Pay, based on your financing terms.

With immediate access to funds and frictionless payments through their preferred method, you don’t just improve convenience - you maximize your credit utilization and customer acceptance rates.

Our virtual card technology enables quick time-to-market, easy scalability and a smooth customer experience, with zero point-of-sale integration required.

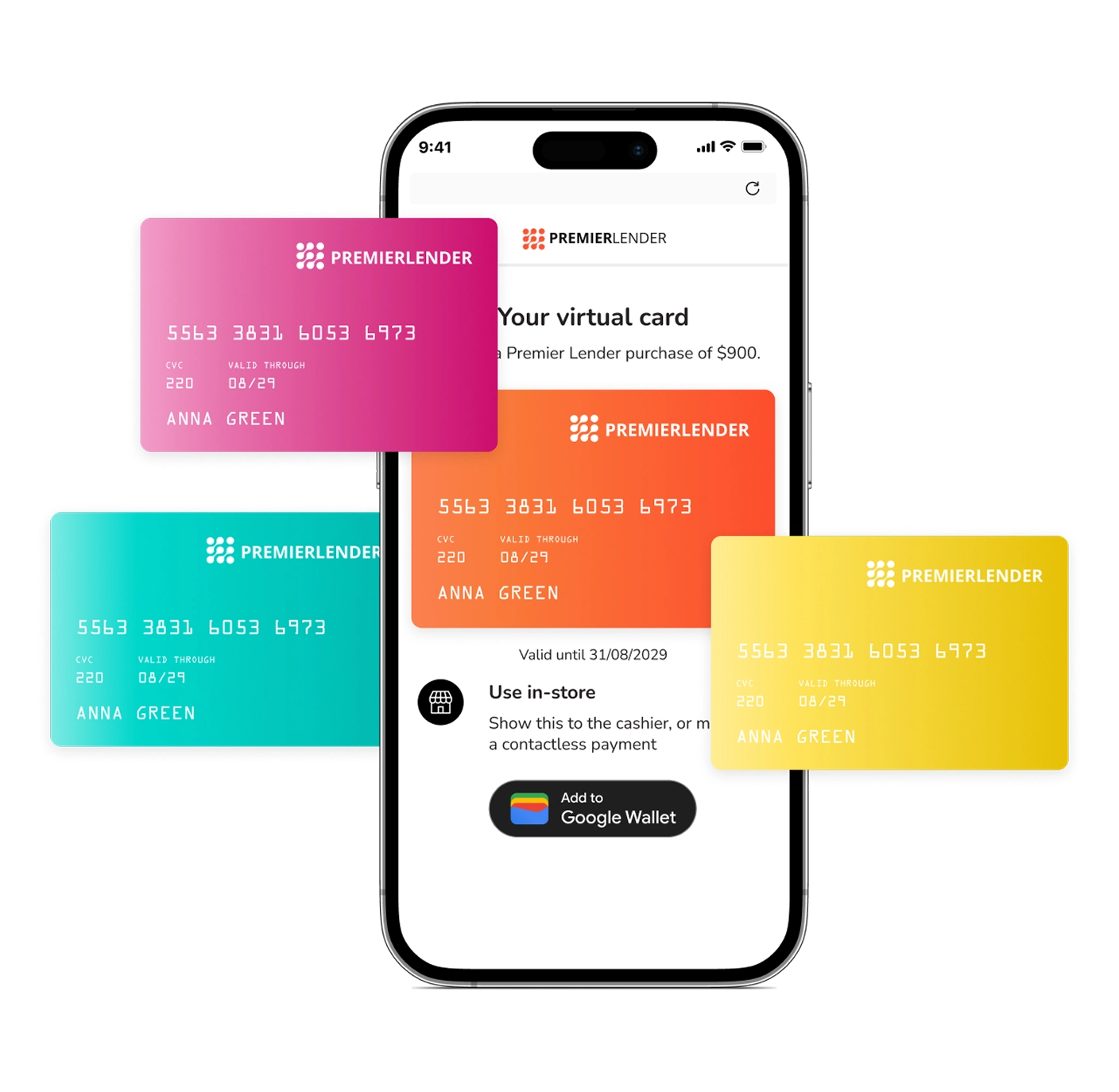

Approved customers are immediately issued a white-labeled virtual card that can be used to close the transaction and disburse funds, based on your terms.

Jifiti can serve as both the issuer and card program manager and the cards can be private label, open loop or restricted open loop - you decide.

Integrate easily with any partner’s point-of-sale with our customizable APIs.

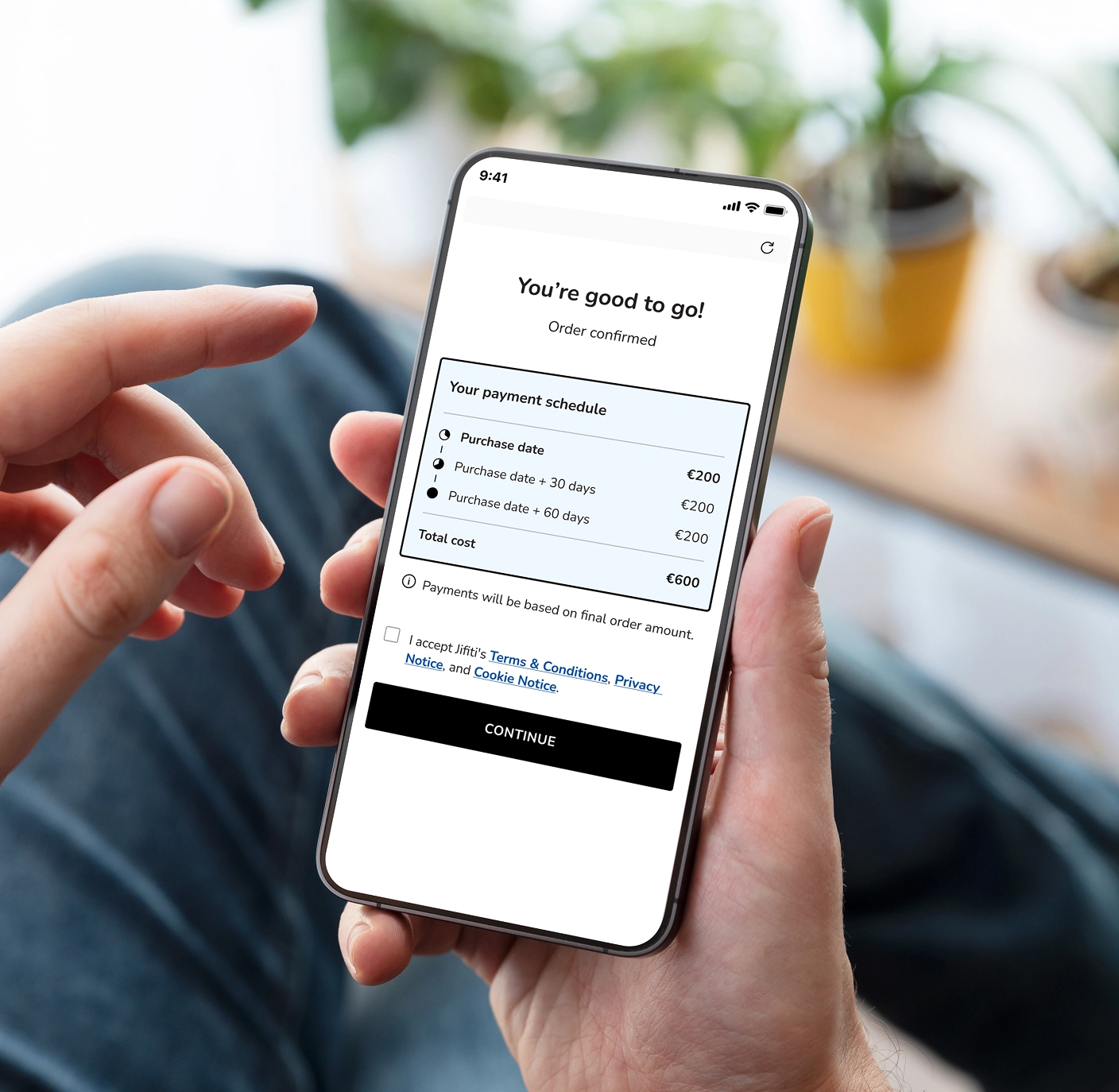

Funds are instantly disbursed to the point-of-sale system, making the transaction ‘business as usual’ for the seller and giving your customer a seamless buying journey.

With a single integration, we can facilitate the seamless transfer of approved funds directly to your customers’ or partners’ bank accounts via secure API calls.

Streamlined settlement and reconciliation processes keep fund disbursement accurate, efficient, and fully auditable.

How it works

Approval & orchestration

Your decisioning parameters approve the loan or credit line. Our orchestration triggers the right disbursement flow

Instant fund transfer

Funds are released immediately based on your loan terms, disbursement flow and controls

Reconciliation

Activity streams to your ledger and reporting, simplifying settlement and chargeback handling

Optimization

Data analytics ensure you can monitor and optimize your fun disbursement flows