Orchestration Layer

We Orchestrate

So

You Can Innovate

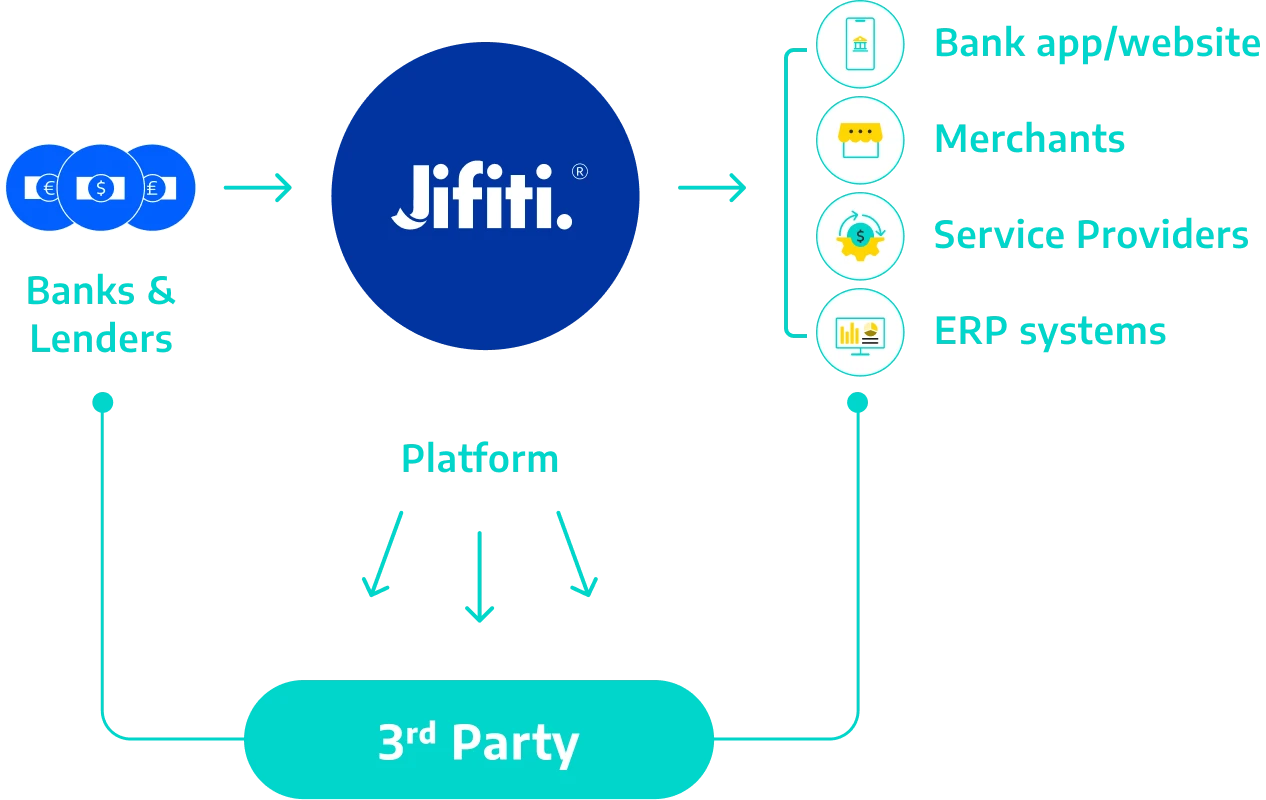

A single API connection with our best-of-breed orchestration layer gives you seamless access to any third-party service your lending stack needs – from KYC and credit bureaus to open banking, fraud prevention and more.

Streamlined Third-Party Connectivity

When a business or consumer applies for a loan, there’s a lot happening behind the scenes.

Orchestration provides a single access point that connects all these best-of-breed third-party services to your internal systems, so the process becomes quick, cost-effective, compliant and seamless – for both the borrower and the bank.

With a strong orchestration layer, you can:

- Reduce manual processes and operational bottlenecks

- Eliminate integration headaches with one secure connection

- Plug in or swap out services without rebuilding your tech stack

- Stay in control of data, flow, compliance, and the borrower experience – without hard-coding every connection

Integrate. Orchestrate. Innovate

Single integration point

instead of one-by-one vendor connections

Compliance-ready

to meet local regulatory requirements

Access our best-of-breed ecosystem

or plug in any vendor you choose

Easily scalable & customizable

per market, use case, partner or channel

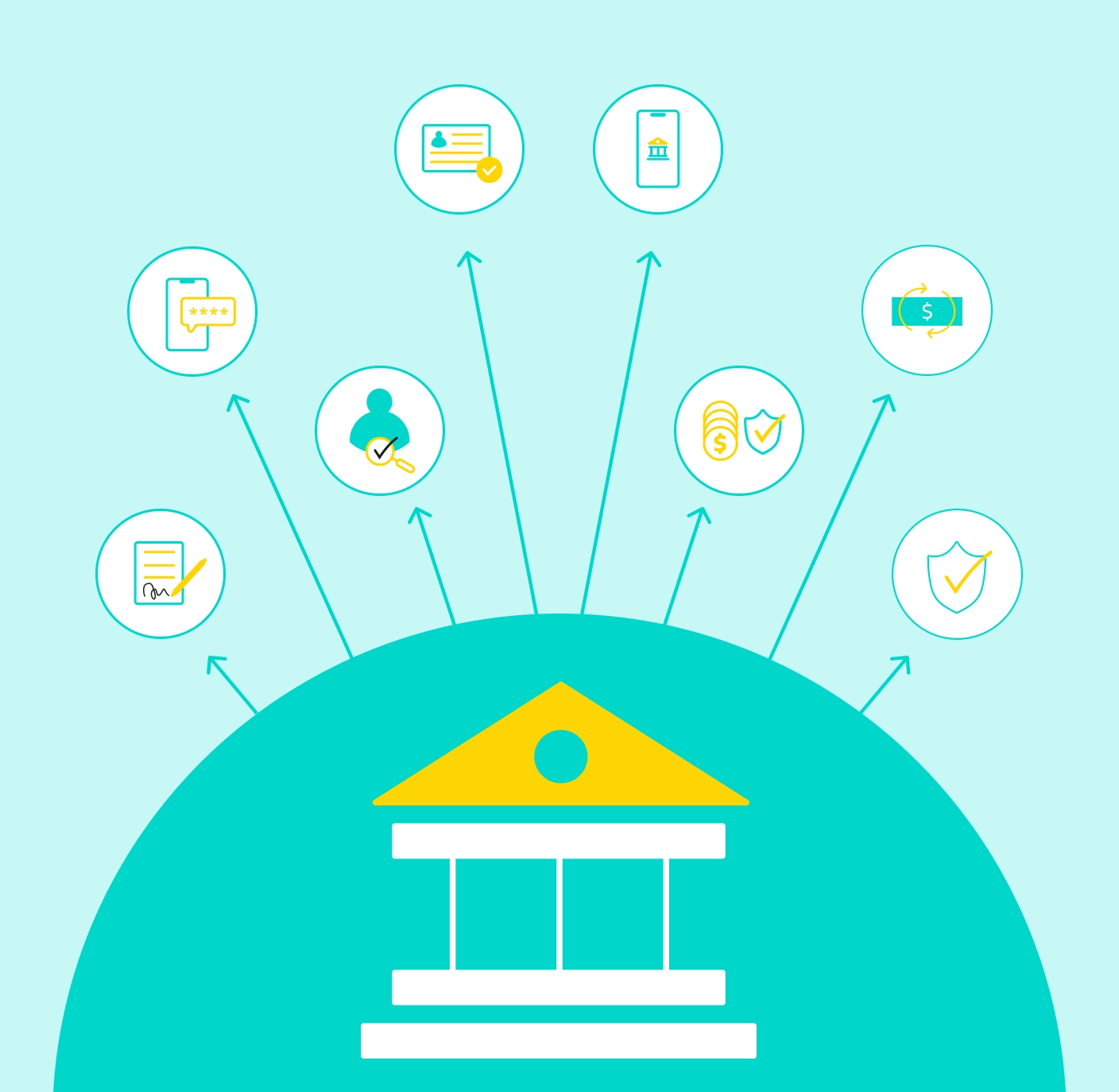

Seamlessly activate any functionality you need

Integrates directly with your core systems for seamless loan servicing and lifecycle management. Ensures consistency, compliance, and real-time synchronization across all lending channels.

Connects to leading payment gateways, processors and digital wallets to seamlessly facilitate disbursements and repayments. Enables flexible, customer-friendly options while ensuring secure fund flows.

Leverages credit, behavioral, and robust, alternative data sources to power automated risk models. Delivers smarter, instant credit decisions that boost approval rates and reduce manual processes.

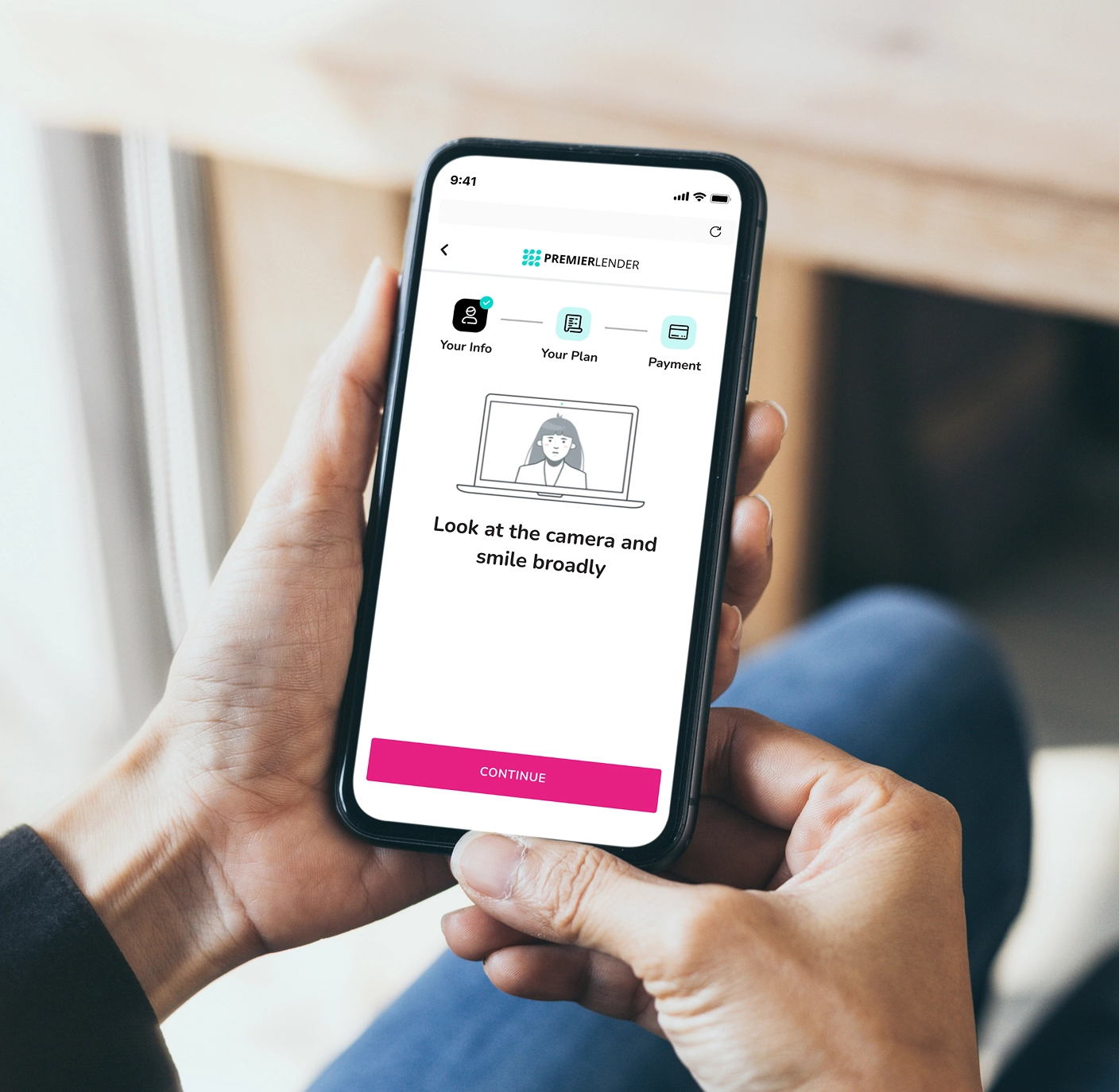

Automates identity validation through biometric, document, and database checks. Reduces onboarding friction while protecting against identity theft.

Ensures regulatory compliance by verifying customers and businesses against official records. Simplifies onboarding while minimizing risk exposure across markets.

Provides access to customer bank data with consent for faster, richer credit assessments. Improves accuracy of affordability checks and widens access to credit.

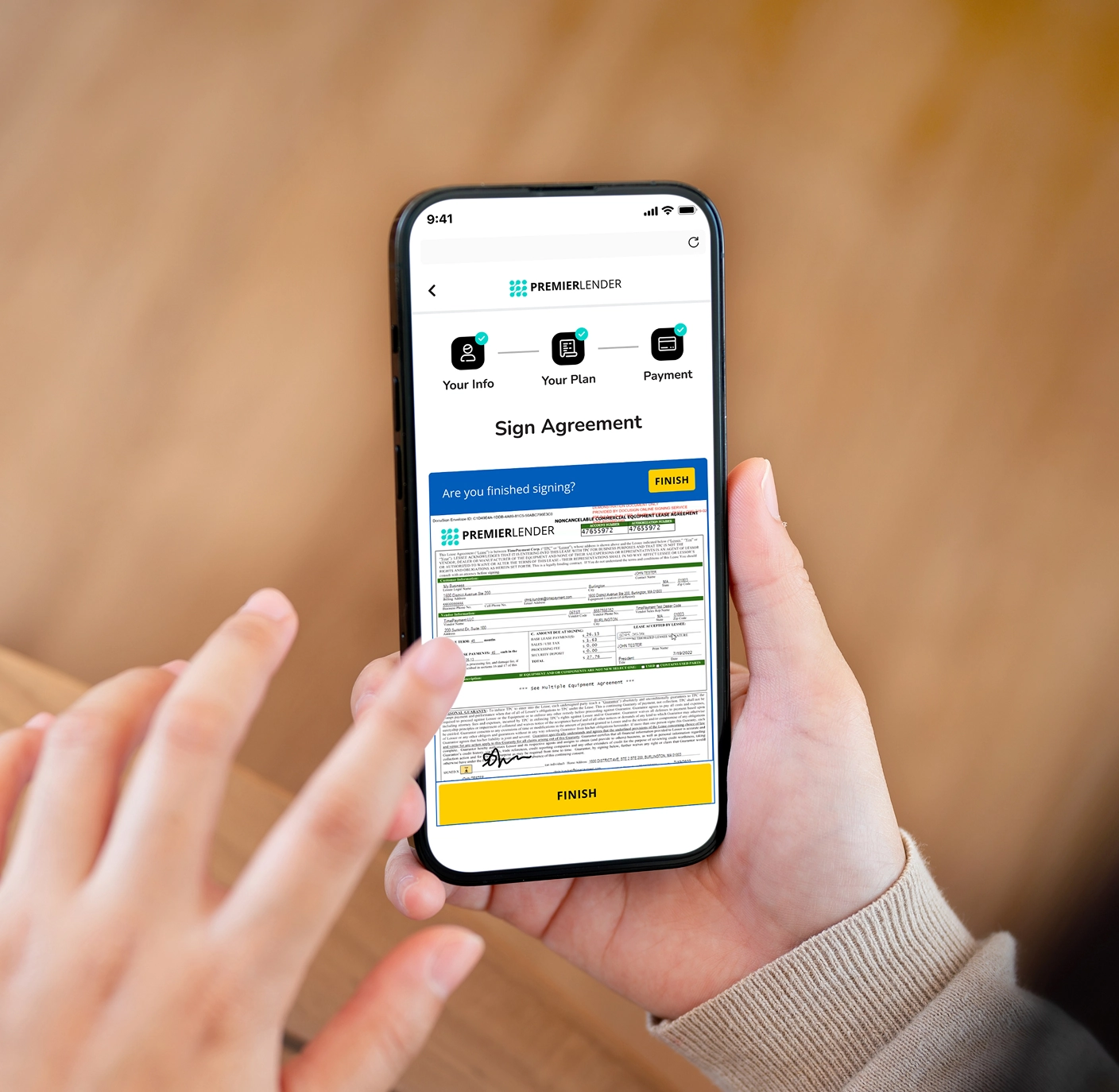

Enables borrowers to securely sign agreements digitally. Accelerates loan origination while maintaining compliance with e-signature regulations.

Connects to fraud detection systems that flag suspicious behavior in real time. Protects both the bank and borrower with advanced monitoring and prevention.

Automates anti-money laundering checks against global watchlists and transaction patterns. Ensures compliance with international regulations without slowing down approvals.

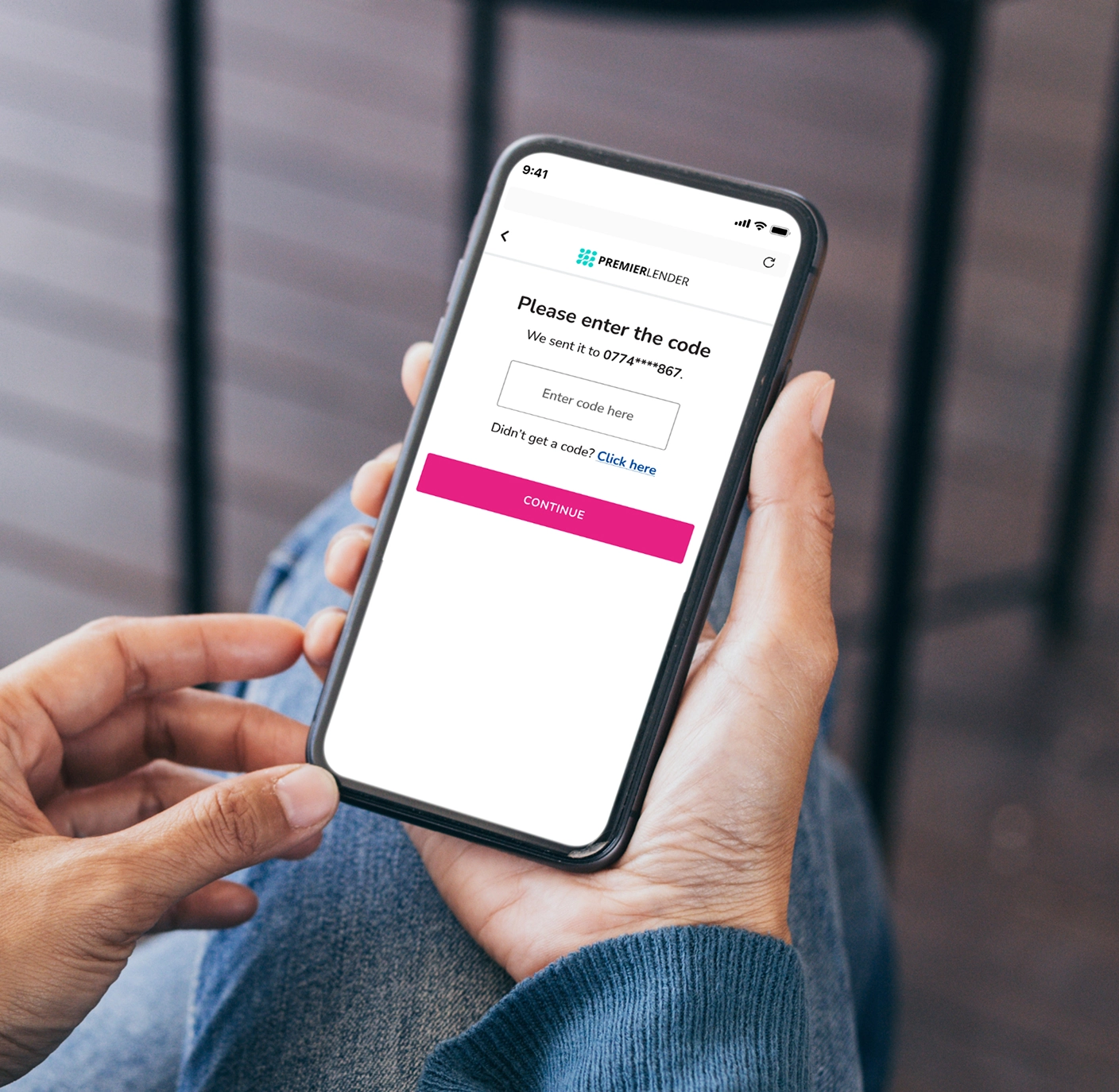

Adds a layer of authentication via one-time passcodes delivered securely to the borrower. Safeguards sensitive lending transactions and strengthens customer trust.

How it works

Integrate Once

Seamlessly connect your lending platform with Jifiti’s orchestration layer via API

Activate Services

Turn on required functionality as needed, including KYC, decisioning, payments, anti-fraud, open banking and more

Scale Easily

Add or swap services without custom dev work, instantly scaling to new use cases, partners or markets

Stay Compliant Without Complexity

Keeping pace with regulatory updates and new market standards is effortless