Customer Access Points

Make Your Loans Instantly Accessible

With our omnichannel lending platform, you can extend your lending to new and existing customers.

Even if they seem out of reach.

24/7

access to your loans for new and existing customers

Omnichannel lending, effortless scale

Customers expect instant digital access to credit wherever they are.

We can help you with that.

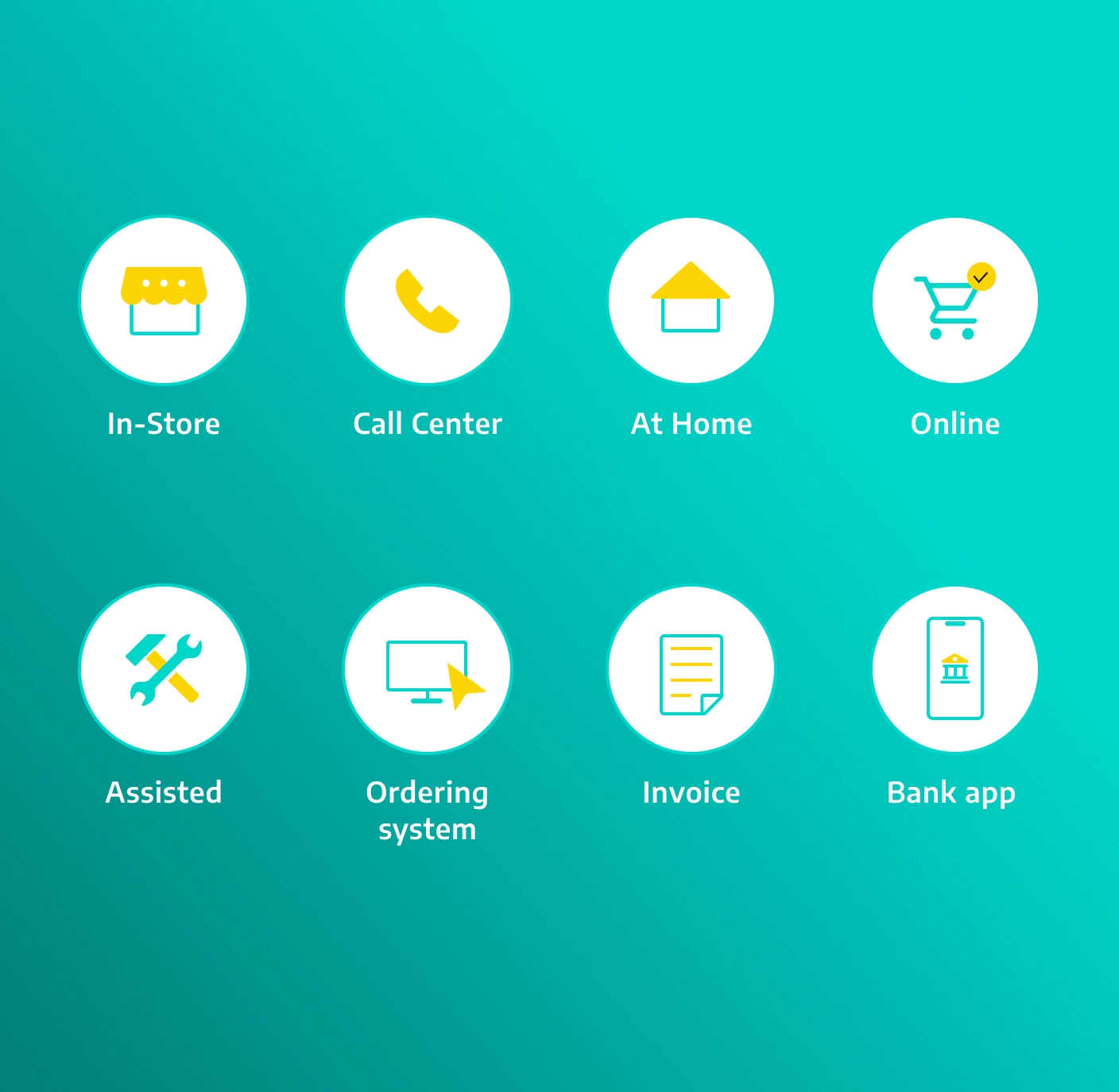

Our technology gives you the ability to extend your lending reach across customer channels – anywhere, anytime, in real time.

From an existing customer applying in your app to a new customer needing financing in-store, we make loan access seamless and effortless.

Scale across channels

Bank-owned channels

Direct-to-customer lending in your app or website to existing and new customers

Third-party channels

White-labeled embedded lending at any customer channel or point-of-sale (online, in-store, via call center and more)

Whatever the channel and integration, we’ve got you covered

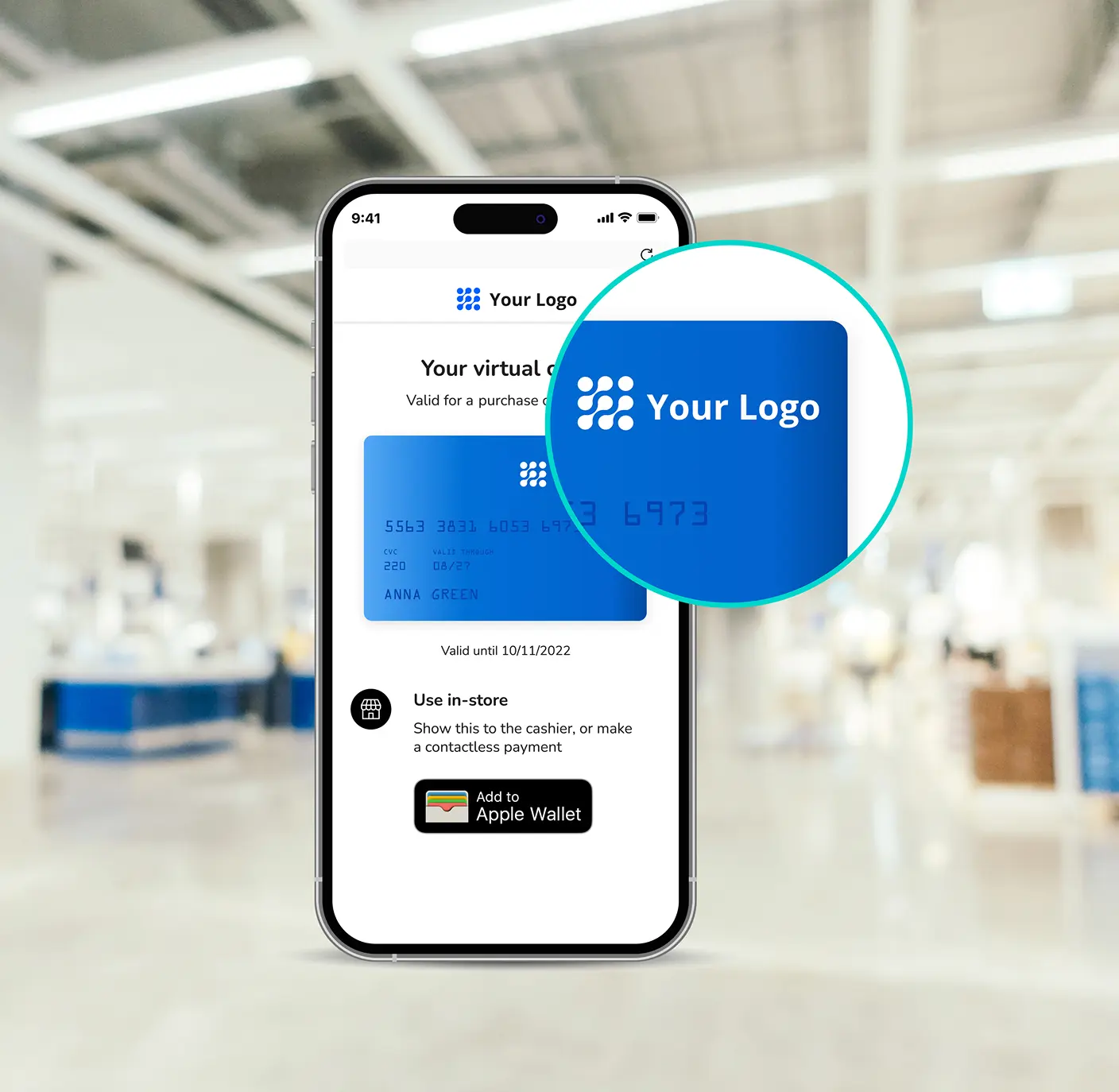

Fully branded and customizable loan application and origination journeys that fit seamlessly into your bank’s or partner’s digital environment. Deliver a native experience that boosts trust, reduces drop-offs, and increases customer conversion rates.

One flexible integration connects your lending capabilities across web, mobile apps, AI tools, in-branch systems and third-party partner channels. Ensure a consistent, compliant experience everywhere your customers interact, while reducing integration costs and time-to-market.

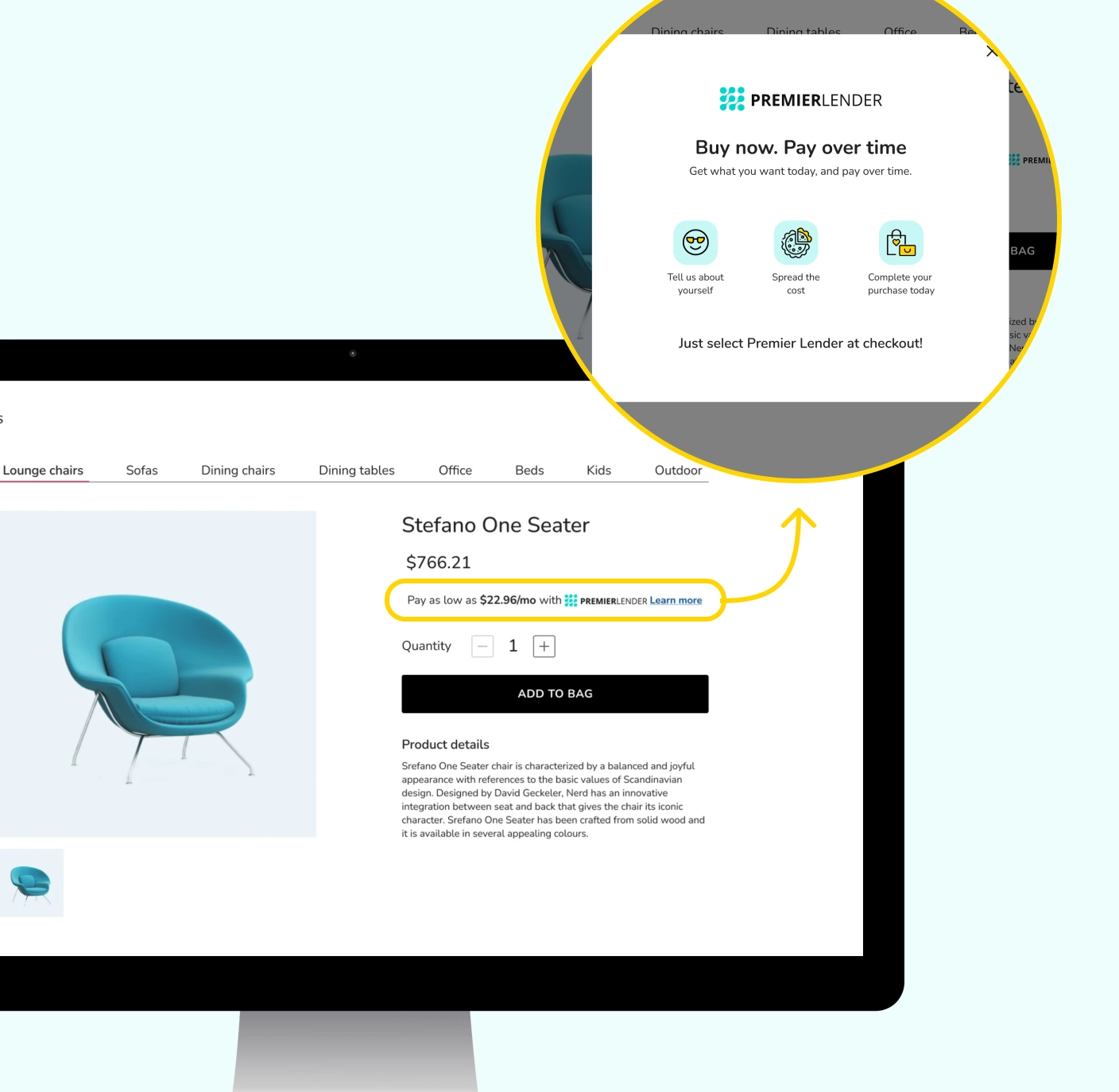

Connect directly to leading global and regional payment gateways to power real-time loan disbursement and point-of-sale financing. Scale across merchants, markets, and payment methods while maintaining compliance and secure transaction flows.

Pre-built connectors for major ecommerce platforms like Shopify, Magento, and WooCommerce. Launch embedded lending quickly, reduce technical effort, and give merchants a seamless way to offer financing at checkout that grows both sales and lending volume.

Lightweight, embeddable tools to dynamically display loan offers, repayment options, or calculators across your site or partner sites. Drive engagement and improve conversions with interactive, branded widgets that require minimal integration.

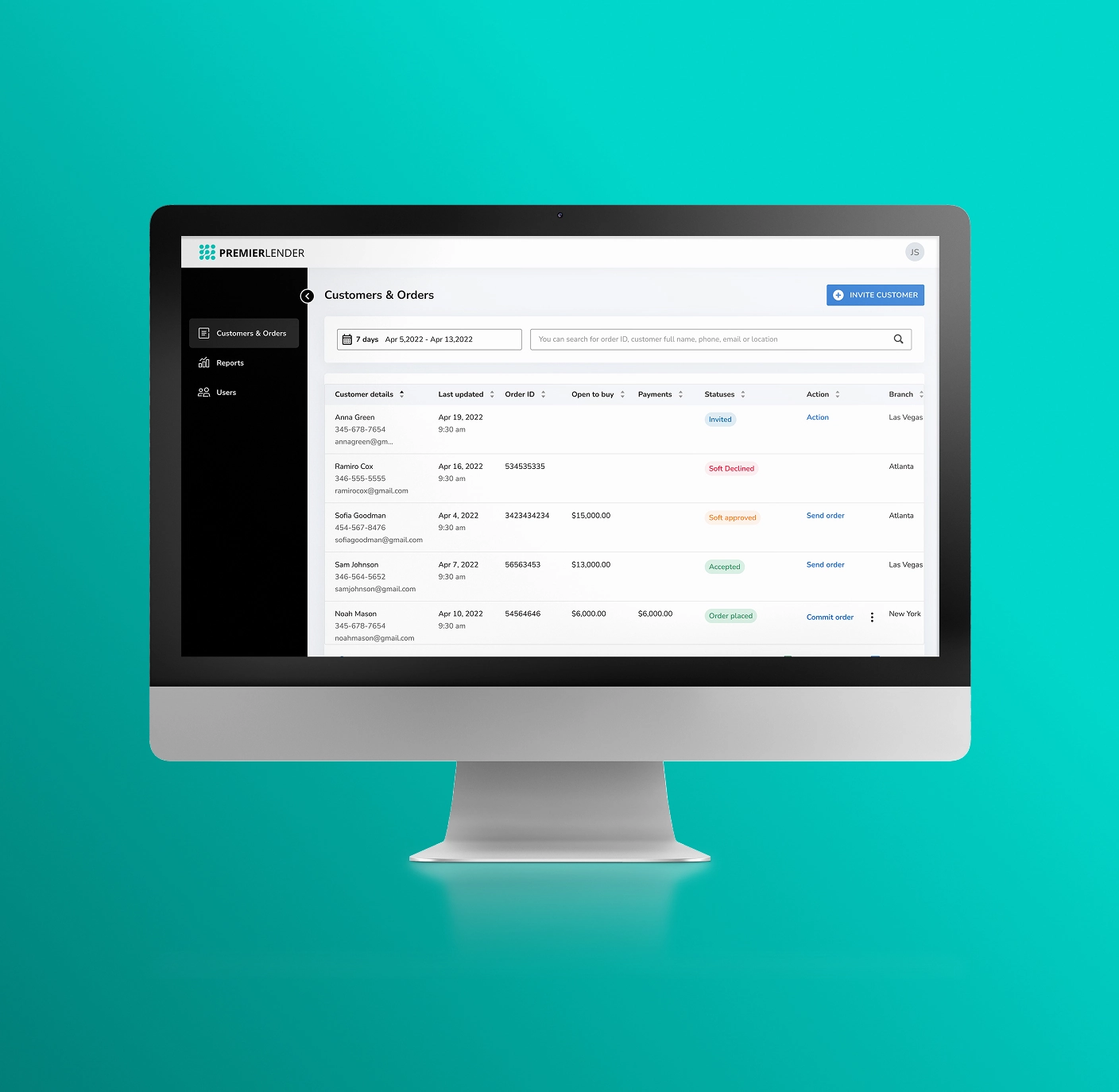

Turn any device into a customer financing control panel with no integration required. Give your partners’ sales teams the ability to initiate customer financing applications, manage transactions, monitor conversions, and optimize campaigns directly from a secure, intuitive dashboard.

Expand your financing program into any in-store or event environment with zero integration required. Customers simply scan a branded QR code to access loan offers instantly, creating new lending channels without disrupting existing merchant systems.

Trusted by Leading Banks and Lenders

With Jifiti, we launched an embedded lending offering across multiple merchants without needing to build a new system internally.

Head of Strategic Partnerships

Tier-1 Bank