Core Lending Capabilities

Digitally Transform Your Core Lending

Digitize, automate and manage any stage of your lending lifecycle – from customer onboarding to origination and servicing – through a single platform integration.

90%

of next-gen borrowers expect a digital end-to-end lending process.*

* Mastercard

Digital, Automated Lending Workflows

Looking to onboard new customers, lend more to existing ones, or digitize any of your loan processes?

Our modular platform has all the technology pieces you need.

When you digitize and automate your lending, you can improve operational efficiency, meet market demand and scale your consumer and commercial lending – quickly, compliantly, flexibly.

Bring your lending workflows into the digital age

Increased customer conversions

with seamless, digital onboarding and origination flows

Lower delinquency rates

through automated loan management processes

Faster application-to-fulfilment times

via automated SMB and consumer journeys

Smarter risk management

with data-driven, compliant decisioning

Choose the core lending capabilities you need

Streamline KYC/KYB and fraud prevention for compliant customer onboarding.

Business onboarding

Digitally onboard business customers with automated document checks and verifications. Ensure compliance with KYB regulations, reduce manual errors, and accelerate approvals so businesses can access credit faster.

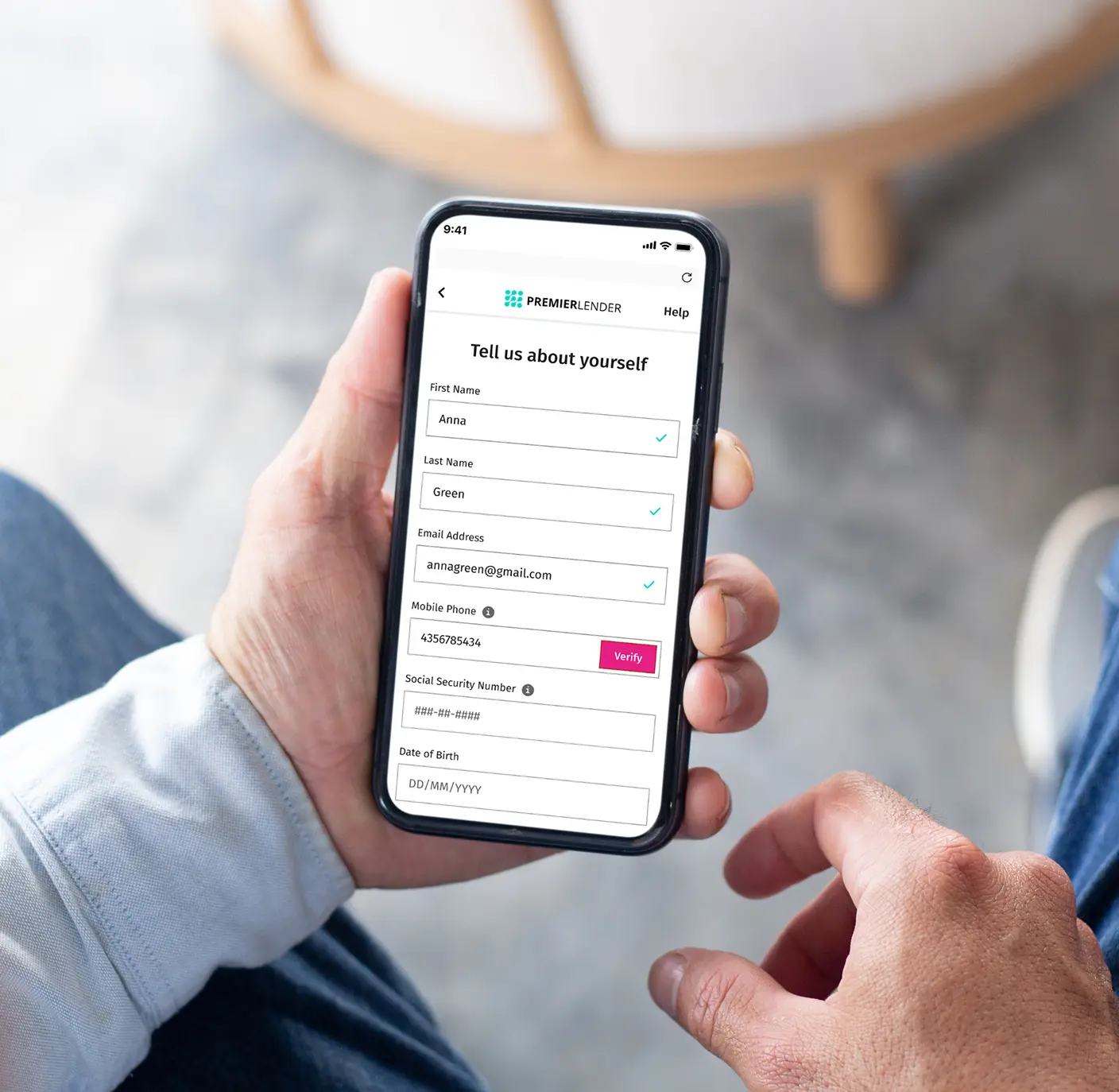

Consumer onboarding

Fast-track consumer sign-ups with simplified, mobile-friendly workflows. Capture customer data seamlessly, verify identities in real time, and cut abandonment rates by delivering a frictionless first impression.

White-labeled end-to-end origination journeys from application to approval.

Credit decisioning

Real-time decisioning based on robust data sources and configurable decisioning rules.

Smart offers

Present personalized, pre-approved offers based on customer data and behavior.

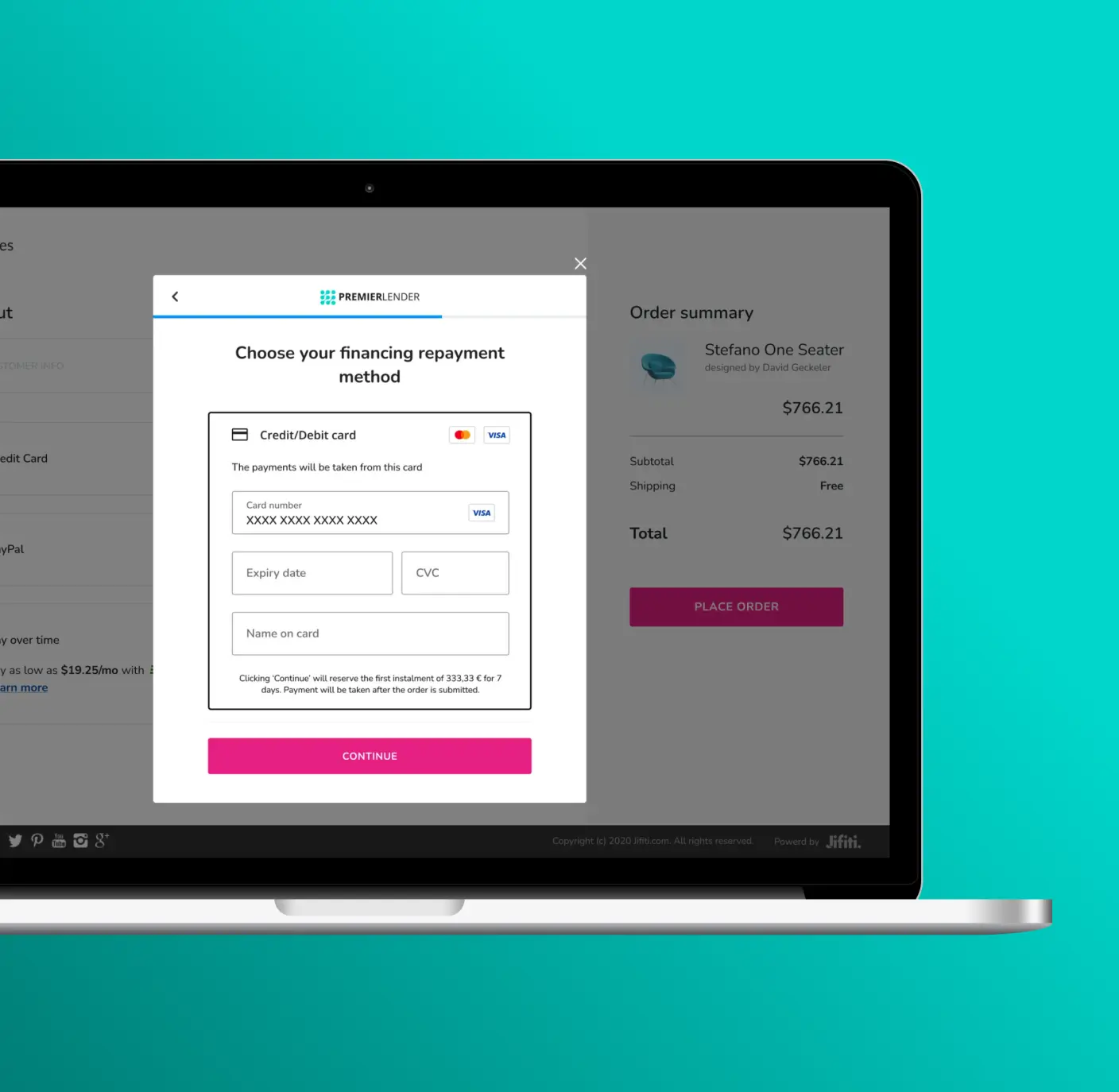

Repayment setup

Flexible, automated repayment schedules and methods to match customer preferences.

Digital management and servicing of active loans, from payments to communications.

Payment collection management

Automate recurring collections based on your terms.

Customer communication & support

Keep customers informed with automated messages and support options.

Customer payment portal

Secure, self-service portal for customers to view balances and make payments.

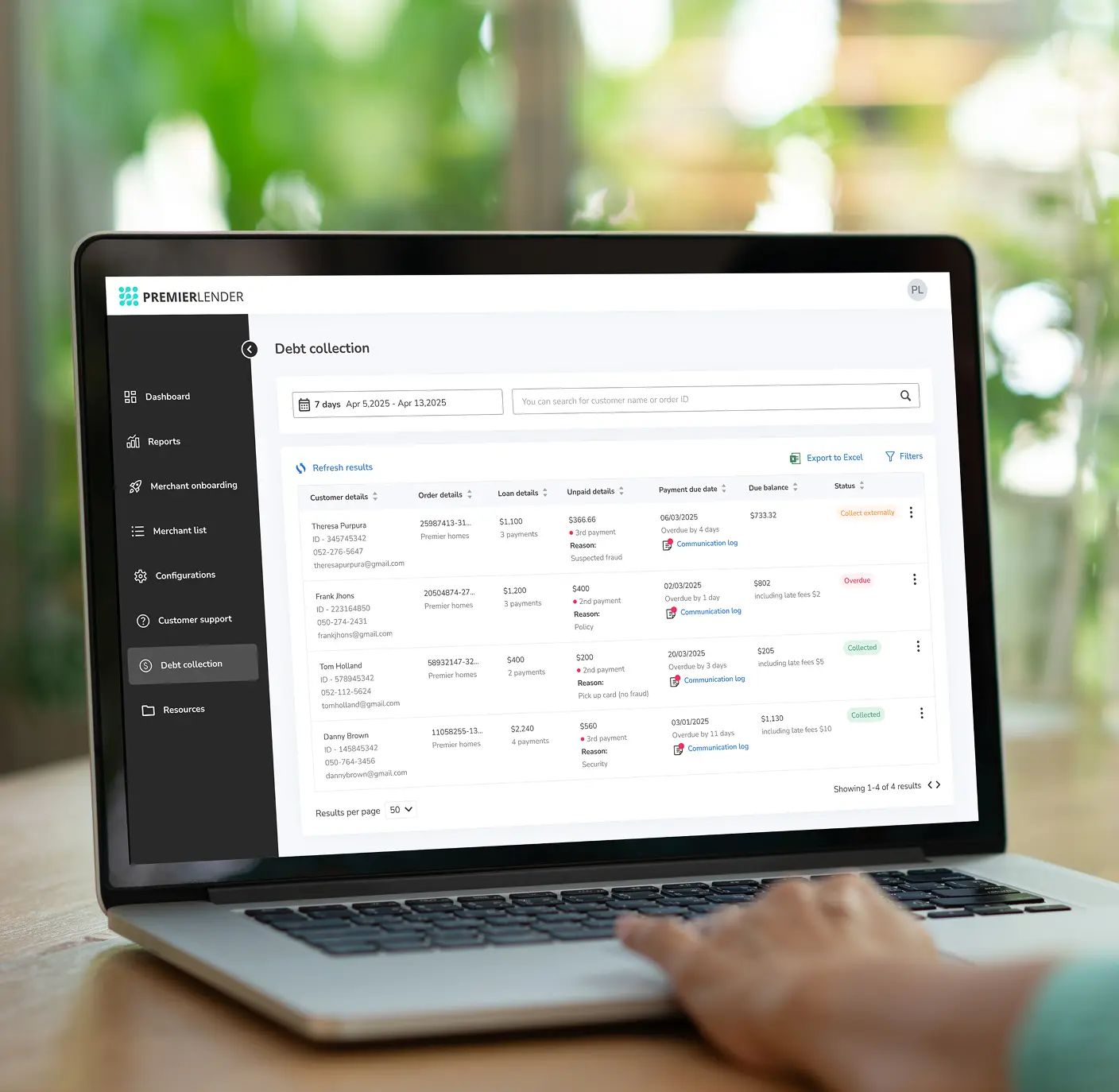

Debt & delinquency management

Monitor, segment, and manage overdue accounts with structured workflow.

How it works

Integrate via API

Seamlessly connect your core systems with our lending platform via API

Pick the components you need

Activate only the capabilities you need for digital customer onboarding, loan origination and loan management/servicing

Customize for your needs

Our white-labeled, fully-customizable and flexible solution puts you in the driver’s seat

Monitor and optimize your loan programs

Smarter loan portfolio optimization driven by actionable data insights